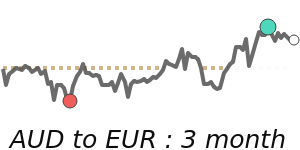

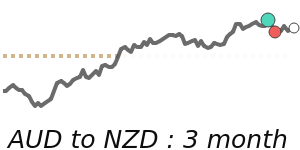

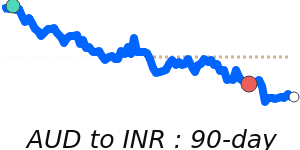

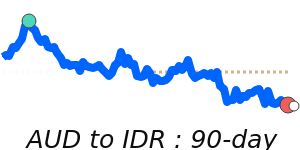

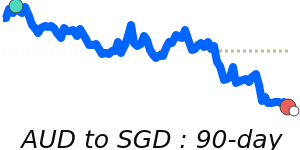

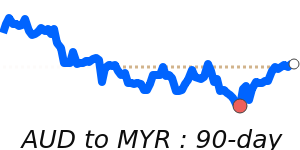

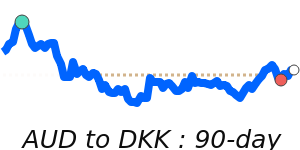

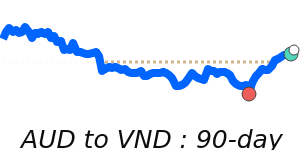

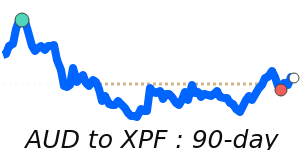

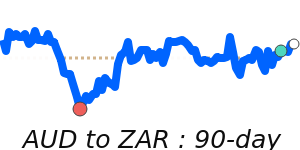

The Australian dollar remains volatile amid ongoing geopolitical tensions, notably related to Iran. Despite strong GDP growth in Australia’s fourth quarter — rising from 0.5% to 0.8% and beating expectations — the AUD has struggled to maintain gains against its main currencies. Yesterday, it initially dipped due to a cautious risk-off mood but then recovered as market optimism briefly returned.

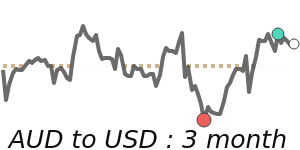

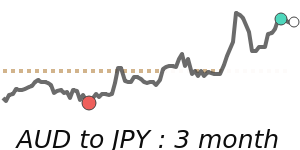

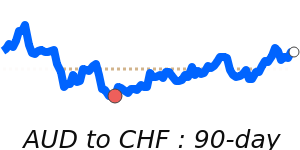

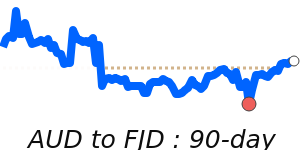

Currently, the AUD has weakened against the US dollar, trading around 0.7037, which is about 2.7% above its three-month average. This decline is typical in a risk-averse environment, where investors flock to safe-haven currencies like the USD. The AUD also saw drops against the Japanese yen and Swiss franc, reflecting heightened global uncertainty and risk sentiment.

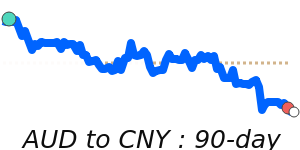

While upcoming trade data could support the AUD if Australia’s trade surplus broadens as expected, the overall tone remains cautious. Elevated oil prices and fears over global growth slowdown — especially related to China — continue to weigh on the AUD. Short-term, the currency is likely to stay under pressure until geopolitical risks ease or market confidence returns.