Recent News

By Currency: USD(33) EUR(22) AUD(21) JPY(18) CAD(13) GBP(13) CHF(12) CNY(9) NZD(7) INR(7) SGD(6) MXN(6) THB(4) RUB(3) SEK(2) TWD(2) VND(2) PHP(2) NGN(2) IDR(2) HKD(2) PLN(1) NPR(1) KRW(1) ZAR(1) LAK(1) MMK(1) SYP(1) TRY(1) PKR(1) RON(1) ARS(1) KES(1) GHS(1) UGX(1) MYR(1) NOK(1) FJD(1)

By Topic: About Us(8) Foreign Transfers(6) Fx Specialists(6) Wise(6) Revolut(5) Travel Money(3) Expat(3) Ofx(3) Fx Analysis(2) Fx Risk(1) Large Amounts(1) Business(1) Foreign Currency Accounts(1) Africa(1) Travel Cards(1) Crypto(1) Study Abroad(1)

Currency Market Update - Week ending 2026-03-14

Weekly currency market update—practical actions for SMBs, expats and travellers across AUD, CAD, GBP, NZD, SGD, USD, EUR and JPY

Biggest Currency Movers – January 2026

January saw clear winners and losers in FX markets, driven by interest rate expectations, risk appetite, and global growth signals.

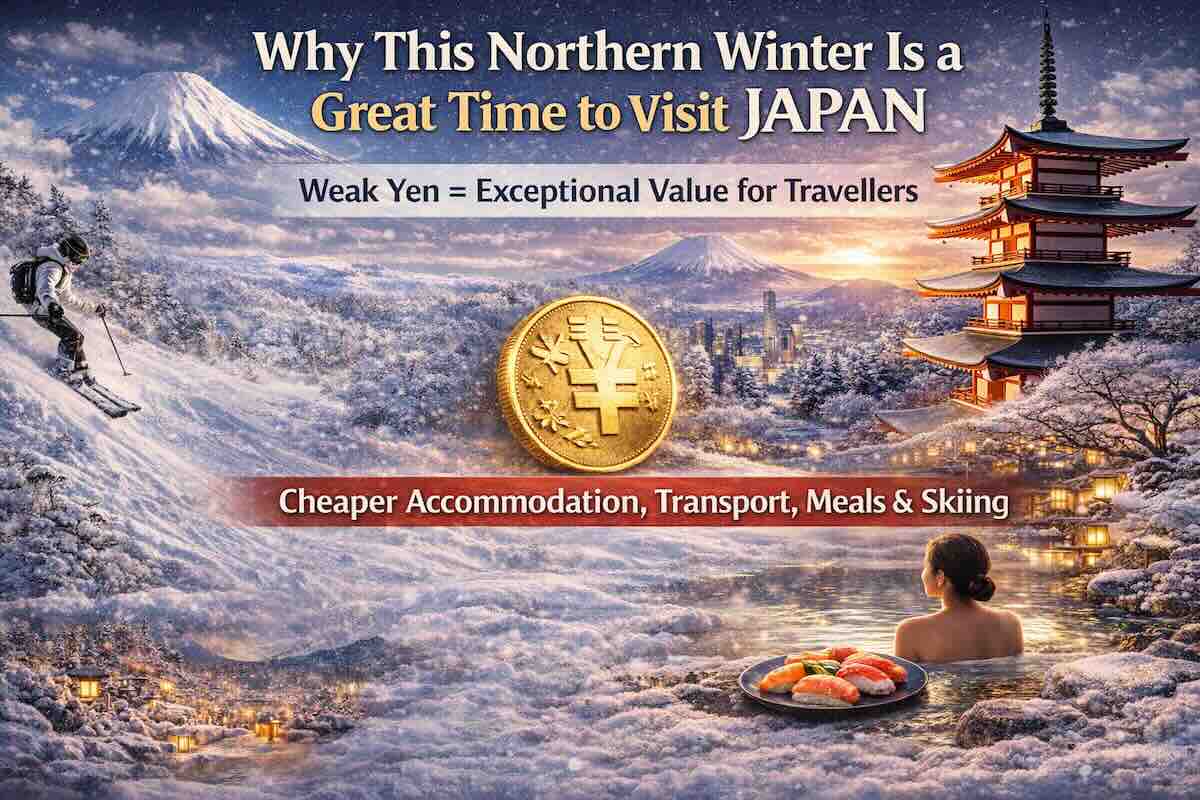

Japan Travel Boom: Weak Yen Makes Winter Trips Exceptional Value

With the yen down sharply against major currencies, winter in Japan offers rare value on hotels, food, transport, and skiing. A rare currency tailwind for travellers.

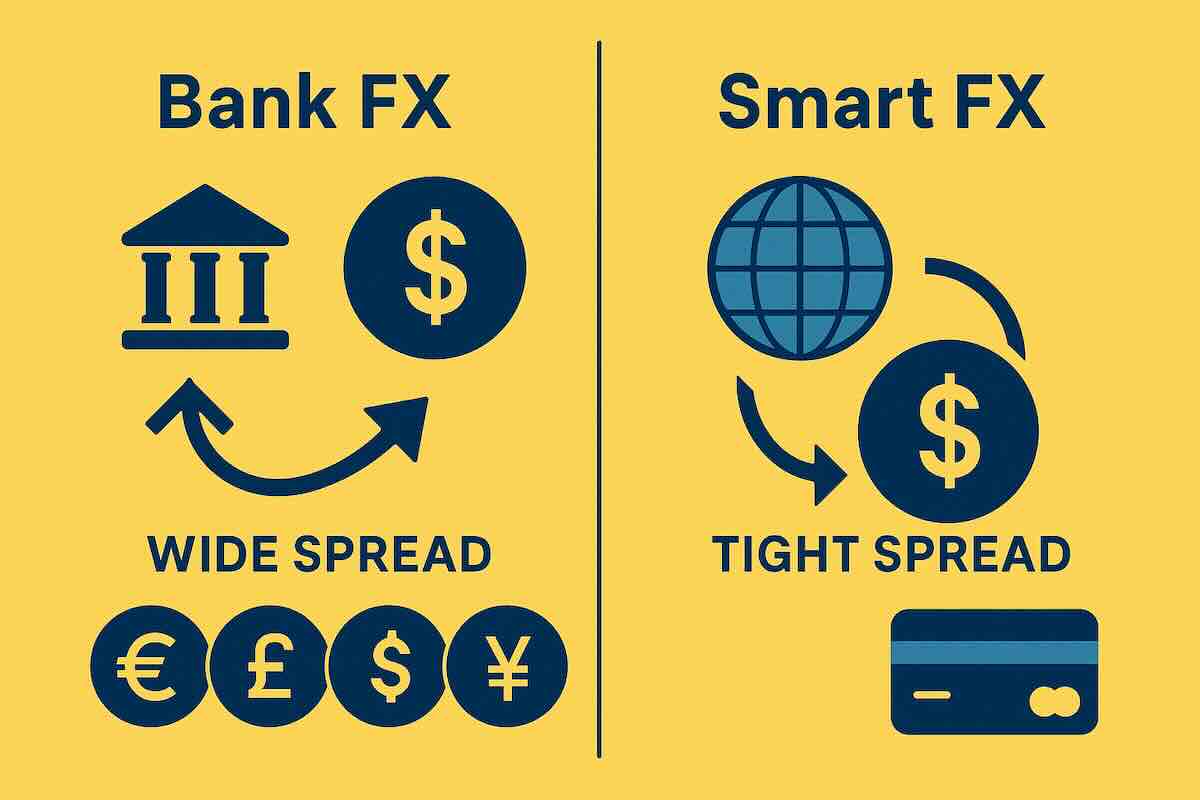

The Most Expensive FX Mistakes People Make

Foreign exchange mistakes rarely feel expensive at the time — but they add up fast. Here are the most costly FX mistakes people make, and how to avoid them.

Australian Dollar Outlook: RBA–Fed Split Could Drive AUD Higher

Markets are rapidly repricing Australian interest rates higher while the US moves toward cuts — a mix that has historically been powerful for the Aussie dollar.

Nepal Raises Daily Remittance Limit to NPR 2.5 Million

Nepal’s central bank has eased foreign exchange rules, increasing the daily inbound remittance cap to NPR 2.5 million (≈ USD 18-20k). Here’s what’s changed and what it means for senders and recipients.

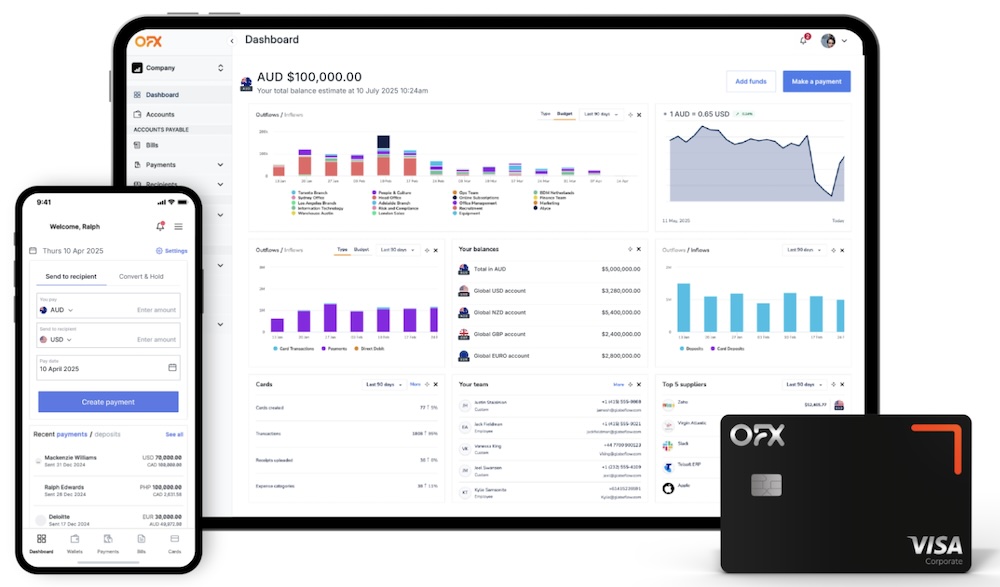

OFX 2.0 for Business: Global Accounts, Cards & Spend Control

OFX has switched on “OFX 2.0” for businesses—adding global currency accounts, corporate cards and spend control, AP/batch tools, and accounting sync. Here’s how it reshapes FX from simple transfers to full finance ops.

Global Central Banks Shift Policy: Key FX Impacts for August 2025

Central banks are moving in different directions—Australia cuts, UK eases despite inflation, and the Fed faces political risks. Here’s what it means for exchange rates and transfer timing.

Revolut rolls out eSIM, Mobile Plans, RevPoints boosts and UK trading

Revolut is doubling down on user perks: cheaper roaming via in-app eSIM, a Mobile Plan on the way, richer RevPoints for travel bookings, and UK/EU stock trading coming soon. Here’s the practical impact for travelers and everyday spenders.

Trump Imposes Broad Tariff Hikes as Global Trade Tensions Escalate

President Trump has raised U.S. tariffs to an average of 15.2%, targeting Canada, Asia, and Europe, as part of his push to reshape global trade. Markets and currencies reacted with caution amid rising uncertainty.

USD/MXN Dips as Mexico Wins 90‑Day Tariff Reprieve

USD/MXN slipped below 19.00 as Mexico received a 90‑day reprieve from planned U.S. tariffs. The peso gained short‑term support, but traders now watch Fed policy and U.S. jobs data for the next market move.

Top 4 travel destinations where the Australian dollar works hardest

Maximise your Aussie dollar abroad. Discover four travel destinations—New Zealand, Indonesia, Vietnam, and Türkiye—where the AUD currently stretches furthest, helping you save on every experience.

Dollar Surges, Rupee Stumbles: What's Driving FX Markets Now

Global FX markets shifted in July as the USD gained on trade deals, the British pound climbed, and the Indian rupee weakened on tariff fears. Here’s what’s driving currencies now.

Swedish Krona's Strength Challenges Euro Adoption Support

The Swedish Krona's recent appreciation has led to a decline in public support for adopting the Euro, with only 32% favoring the change in 2025.

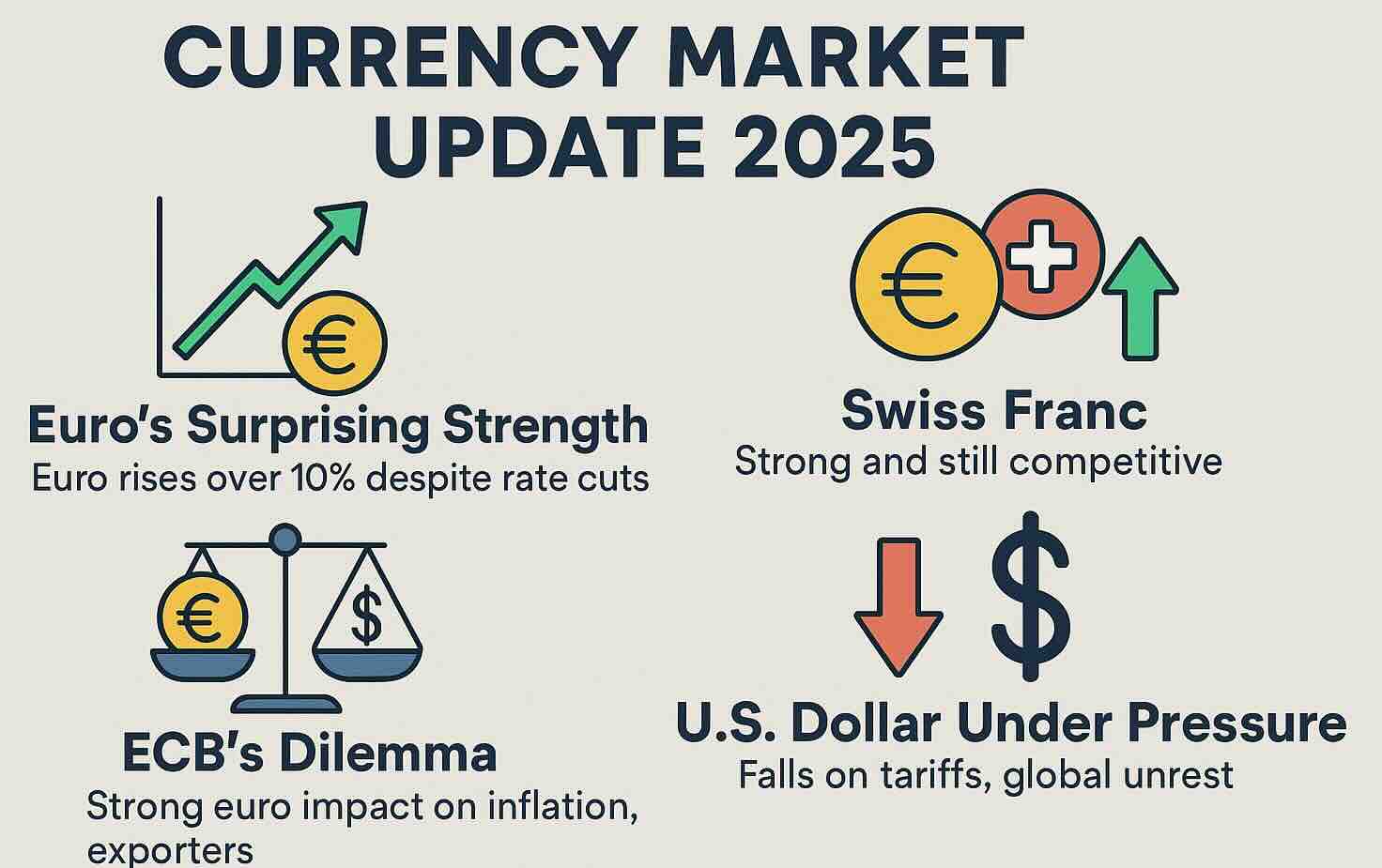

Global Currency Shake-Up: Euro Surges, Dollar Stumbles, Franc Holds Strong

The euro's unexpected rise against the U.S. dollar presents the European Central Bank with a complex dilemma, as global trade tensions and policy shifts influence currency dynamics.

Volatile May for Foreign Exchange Rates: EUR, GBP, JPY, AUD, NZD, RON

In May 2025, currency markets experienced notable fluctuations influenced by geopolitical developments, economic policies, and trade relations. The pound (GBP) and euro (EUR) were strong while U.S. dollar (USD) exhibited a weakening trend, while several other currencies demonstrated strength.

US-China Trade Truce Boosts Dollar, Euro and Yen React

The US dollar surged following a 90-day tariff pause between the US and China, while the euro and yen weakened in response.

Aussie Dollar's 2025 Performance and Impact of Labor Party's Landslide Victory

The Australian dollar has experienced notable fluctuations in 2025, influenced by global trade tensions and domestic political developments, including the Labor Party's decisive election win. However, trade tariffs imposed by the United States, have introduced volatility, prompting market analysts to adjust their forecasts for the currency's trajectory.

Loonie Resilience Defies Odds Amid Carney Election and Trade Tensions

The Canadian dollar has defied political chaos and global headwinds to emerge as one of 2025’s unlikely winners. But with minority rule in Ottawa, soaring household debt, and a high-stakes U.S. election looming, the loonie’s fight for survival is just beginning.

Argentina's Peso Surprises Markets Amid Economic Reforms

Milei publicly criticizes economists as econo-swindlers and alarmists as Argentina's peso has defied expectations by maintaining stability following recent economic reforms, easing inflation concerns and bolstering investor confidence.