The Australian dollar (AUD) has been on a gradual upward trend, influenced by a cautiously optimistic market sentiment surrounding the geopolitical situation in the Middle East. However, as markets adjusted, the momentum of this risk-on rally has shown signs of softening, which may hinder further gains for the AUD moving forward.

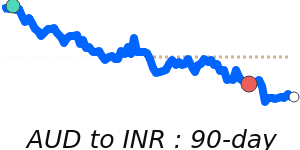

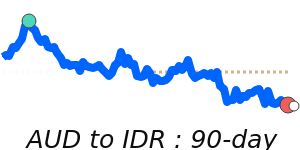

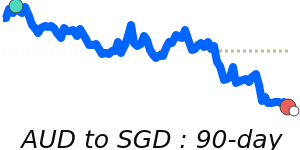

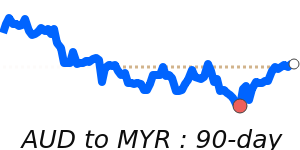

Recent developments offer a mixed outlook for the AUD. The Reserve Bank of Australia's (RBA) decision to hold interest rates steady reflects a cautious approach amid global economic uncertainties, which could lead to continued volatility in the currency. Furthermore, declining commodity prices, particularly for iron ore and coal—key exports for Australia—could exert downward pressure on the AUD as they impact national revenue.

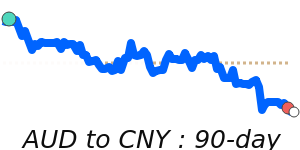

Economic data from China, Australia’s foremost trading partner, has also been disappointing, raising concerns about future demand for Australian goods. Analysts suggest that weaker Chinese economic indicators could be detrimental to the AUD, particularly given the currency's sensitivity to global trade dynamics. In addition, recent employment figures indicate a surprising decline, potentially signaling underlying economic challenges that may influence market sentiment towards the currency.

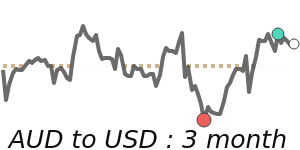

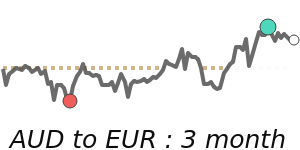

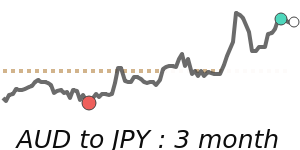

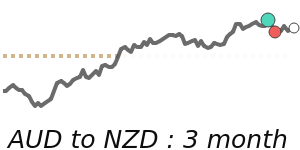

On the trading front, the AUD to USD exchange rate currently stands at 0.6533, which is 2.0% above its three-month average of 0.6408. This exchange rate has moved within a volatile range of 9.9% in recent weeks. Meanwhile, the AUD to EUR is trading near 60-day lows at 0.5570, 1.4% below the three-month average, while AUD to GBP remains relatively stable, just 0.8% below its three-month average at 0.4762. Lastly, the AUD to JPY has seen a notable increase, currently at 94.44, 1.9% above the three-month average.

As global risk appetite fluctuates amid rising geopolitical tensions and inflationary pressures, the AUD's performance could continue to be affected by these broader economic conditions. Stakeholders should stay attuned to these factors as they have the potential to significantly influence the currency's trajectory in the coming weeks.