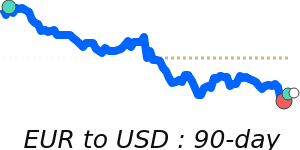

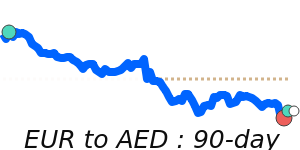

The euro (EUR) has recently come under pressure due to its negative correlation with a strengthening US dollar (USD). Following the release of the Eurozone’s final services PMI, which indicated stagnant activity, the EUR trended lower. Analysts suggest that with German factory orders and Eurozone PPI expected to decline, the EUR faces additional headwinds. Comments from European Central Bank (ECB) President Christine Lagarde may provide the euro with some relief if they lean towards a hawkish stance.

Recent developments indicate that inflation in the Eurozone remains elevated, complicating the ECB's monetary policy decisions. Speculation around potential pauses in interest rate hikes has raised concerns about the stability of the euro. This, coupled with signs of slowing GDP growth and ongoing geopolitical tensions, particularly concerning trade relations with the U.S. and the U.K., has contributed to a cautious market sentiment surrounding the currency.

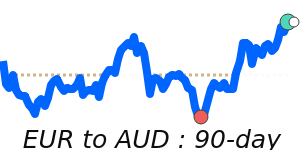

Energy prices, which have been volatile, also play a crucial role in shaping the Eurozone's economic landscape. The ongoing impact of reduced Russian gas exports continues to exert inflationary pressures, and fluctuations in global energy prices influence the euro's strength.

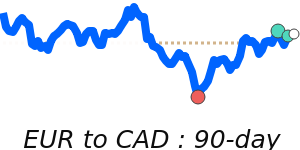

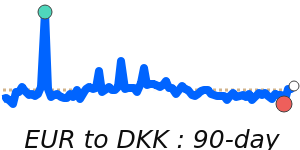

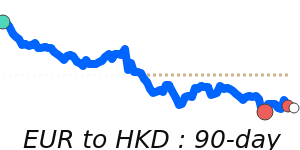

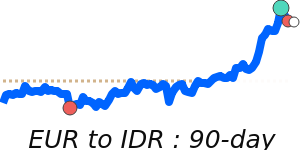

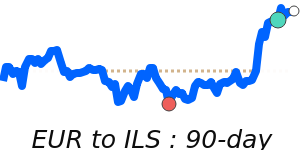

In terms of trading performance, the EUR/USD is currently at 1.1770, representing a 3.4% increase from its three-month average of 1.1383, and has shown considerable volatility, trading within an 8.4% range. The EUR/GBP stands at 0.8611, 1.2% above its average of 0.8505 and indicating a stable trading range, while the EUR/JPY is trading at 170.4, a 3.6% rise above its average, reflecting higher investor interest.

Market experts note that the euro's performance could be affected by fluctuations in oil prices, which are currently trading at 68.80, 3.2% above their three-month average. A volatile range of 31.1% reflects ongoing uncertainty, which may also influence investor sentiment towards the euro.

Overall, the outlook for the euro remains contingent on upcoming economic data, ECB policy direction, and geopolitical developments, making vigilance essential for those involved in international transactions.