The Hong Kong dollar (HKD) has exhibited resilience amid ongoing uncertainties in the U.S. interest rate landscape, particularly through October 2023. Analysts noted that a recent easing of inflation, alongside new government policies introduced by Chief Executive John Lee, aimed at bolstering Hong Kong’s status as a key global financial and trade center, supported the currency's stability. However, the overall economic recovery remains sluggish, presenting challenges for sustained HKD strength.

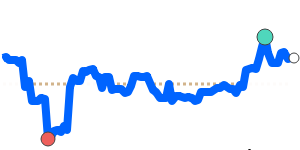

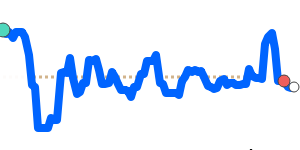

In the face of previously draconian tourism restrictions being relaxed, there remains a pervasive sense of pessimism regarding the city's economic future. While the HKD traded stable against the U.S. dollar during the year, minor fluctuations were observed. Specifically, the HKD to USD exchange rate recently hovered around 0.1274, reaching a 90-day low, just below its 3-month average, indicating limited movement within a narrow range of 1.3%.

Moreover, the domestic government's measures, aimed at revitalizing the property sector, have garnered some market attention, yet the response has been mixed. Reduced stamp duties and eased mortgage conditions showed promise, but the underlying economic indicators, including a GDP growth rate of only 0.4% for Q4 and a PMI score under 50, highlight the prevailing economic headwinds. Therefore, future HKD strength is contingent on a more robust economic bounce-back and the Federal Reserve’s interest rate policy.

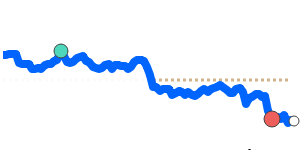

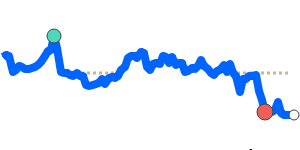

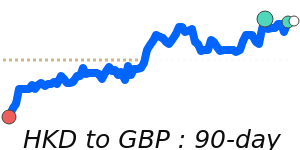

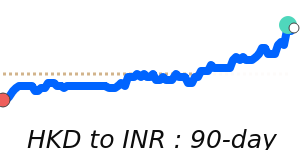

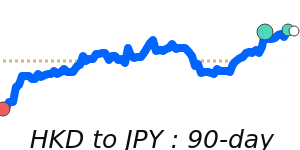

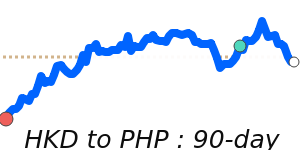

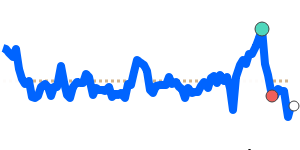

Conversely, the HKD showed some upward momentum against the Euro and the British pound, with exchange rates reaching 14-day highs of 0.1090 and 0.094379 respectively. Despite these gains, the HKD's performance relative to the euro falls 2.6% below its 3-month average, suggesting possible volatility. Additionally, against the Japanese yen, the HKD is performing relatively well, currently trading at 18.78, above its 3-month average and reflecting a stable trading range.

Overall, market sentiment remains cautious, with analysts observing that the HKD’s strength in the coming months will largely depend on the degree of recovery in the local economy and any shifts in the Federal Reserve’s stance on interest rates.