HKD Market Update

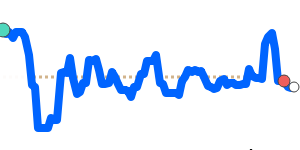

The Hong Kong dollar has remained relatively steady against major currencies recently. against the US dollar, HKD is trading just below 0.128, near its recent 3-month average, in a narrow range. This stability comes as the HKMA keeps its base rate at 4.0%, matching the US Federal Reserve’s pause, which supports the HKD’s peg to the dollar.

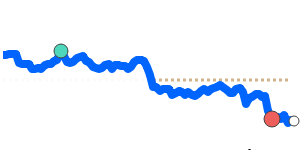

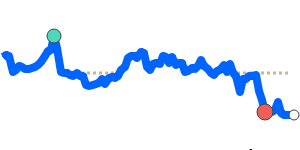

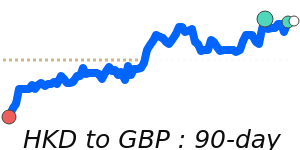

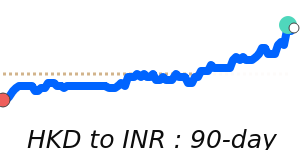

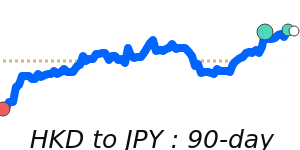

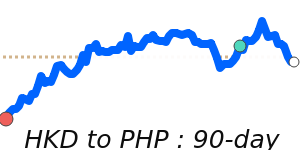

Meanwhile, the HKD has gained strength against the Euro and British pound, reaching 90-day highs near 0.1111 and 0.0962 respectively. Both remain well above their 3-month averages, indicating a modest upward trend but within stable trading ranges.

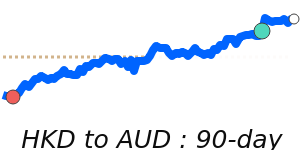

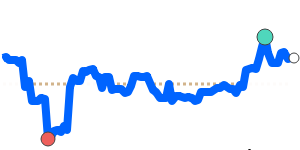

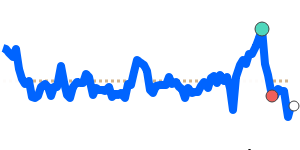

Conversely, the HKD has softened slightly against the Australian dollar and Canadian dollar, trading below their 3-month averages. The HKD/ AUD exchange rate is about 1.9% lower, and the HKD/CAD is just over 1% below the average, reflecting some regional currency movements amid stable global conditions.

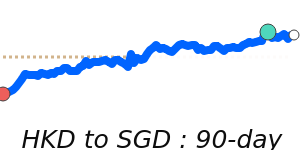

Overall, the HKD maintains stability amid close alignment with US monetary policy and solid economic indicators, with only minor fluctuations against key currencies.