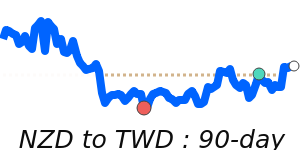

New Zealand dollar (NZD) Market Update

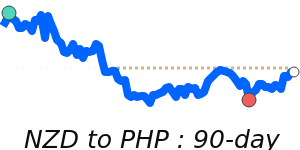

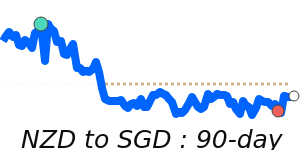

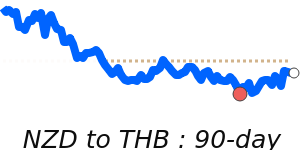

The New Zealand dollar (NZD) is currently facing uncertainty, as recent developments, including U.S. tariffs announced by President Donald Trump on imports from New Zealand, create significant volatility in the currency markets. Analysts note that further tariffs could dampen demand for New Zealand's key commodities, which play a crucial role in shaping the NZD's value against major currencies.

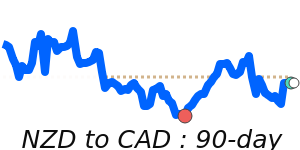

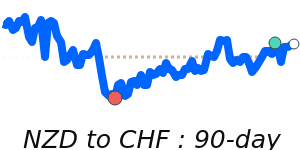

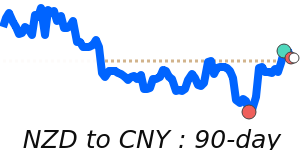

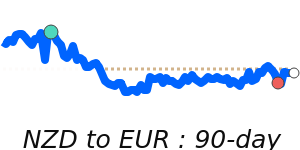

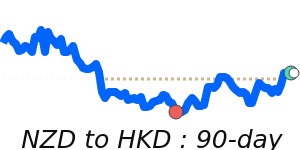

Yesterday, the NZD fluctuated widely, as market participants responded to the Federal Reserve's decisions, ongoing trade negotiations, and various global events. With New Zealand's economic data light today, the 'kiwi' is likely to remain sensitive to global risk sentiment. This uncertainty is underscored by the NZD's current position at 0.5911 to the USD, which is 2.3% above its three-month average of 0.5778, reflecting a volatile trading range of 8.5% from 0.5534 to 0.6007.

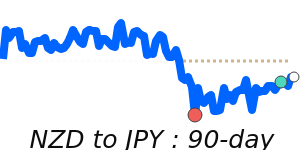

In contrast, the NZD is trading at near seven-day lows against the Euro at 0.5254, slightly below its three-month average of 0.5297, and has experienced an 8.7% trading range. The NZD also shows vulnerability against the pound, currently at 0.4442, just below the three-month average, having fluctuated in a stable 5.4% range. For the yen, the NZD is trading at 85.93, which is marginally above its average, with a relatively stable trading range of 7.9% observed.

Market experts indicate that movements in the NZD and AUD are often correlated, owing to their geographic proximity and reliance on commodity exports. As global economic dynamics evolve, especially with the potential for stricter tariffs from a continuation of Trump's policies, the outlook for the NZD remains clouded with risk, necessitating close monitoring of ongoing developments.