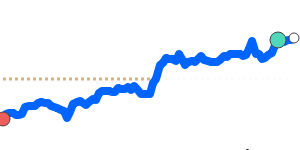

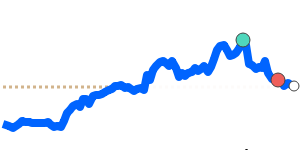

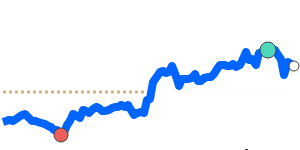

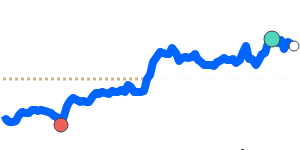

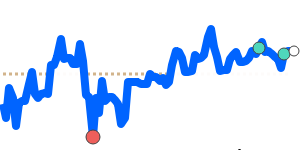

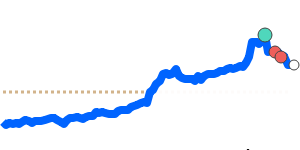

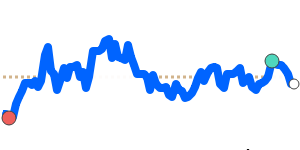

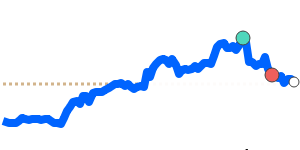

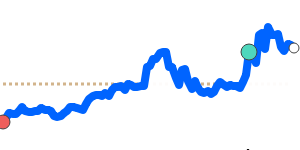

The recent performance of the USD to SEK exchange rate indicates that the US dollar has seen some appreciation amidst positive trade deal sentiments and a reduction in expectations for Federal Reserve interest rate cuts. Analysts have noted that the USD has benefitted from safe-haven flows, particularly during periods of economic uncertainty and geopolitical tensions, solidifying its status as the world’s dominant currency. As of now, the USD to SEK rate stands at 9.5604, which is only 0.6% below the three-month average of 9.6149, suggesting a period of relative stability within a 4.5% trading range.

In terms of future forecasts, experts indicate that the strength of the US dollar will largely be influenced by the Federal Reserve's policy decisions, alongside key economic indicators such as inflation, employment data, and GDP growth. If the Fed adopts a more hawkish stance by raising interest rates, this could lead to further strengthening of the dollar, particularly as investors seek attractive returns in a climate of rising rates. Conversely, any disappointment regarding the anticipated trade deals could pose challenges for the dollar in the near term.

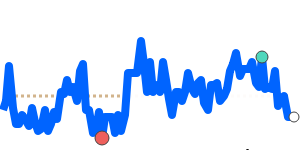

On the other hand, the Swedish Krona (SEK) is impacted by domestic monetary policy and broader external factors. Recently, Sweden's central bank has expressed a willingness to consider rate adjustments in response to inflation trends, with markets anticipating potential interest rate cuts as early as May. Any significant policy shifts from the Riksbank could influence the SEK's trajectory against the USD.

Overall, the current analysis suggests that both currencies are poised for movements influenced by monetary policy changes, economic performance, and geopolitical events. The interplay between these factors will be crucial for forecasting the USD to SEK exchange rate in the upcoming months. Investors and businesses should remain vigilant to any developments, as these may offer opportunities to navigate international transactions more effectively.