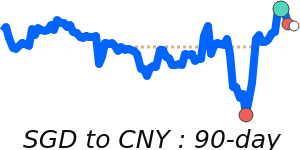

The recent outlook for the Singapore Dollar (SGD) has been influenced by increasing trade tensions following U.S. President Donald Trump’s announcement of a 10% tariff on imports from Singapore, part of a broader trade conflict impacting multiple economies. Analysts suggest that the renewed fears of a global trade war have led to a decline in risk appetite, considerably affecting regional currencies. The SGD has shown some resilience, but the sentiment surrounding emerging Asian currencies remains pessimistic.

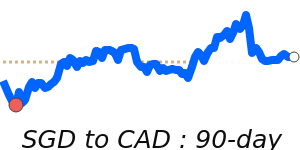

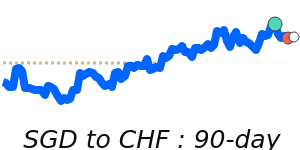

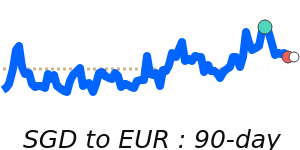

In terms of recent performance, the SGD to USD exchange rate has reached 90-day highs near 0.7869, representing a 2.3% increase above its three-month average of 0.7695. This indicates a stable trading range, reflecting a robust demand for the SGD against the USD amidst the mounting trade anxieties. Conversely, the SGD to EUR has been hit harder, dropping to 60-day lows near 0.6671, which is 1.5% below its three-month average. This trend underscores the impact of external pressures on the SGD relative to the Euro.

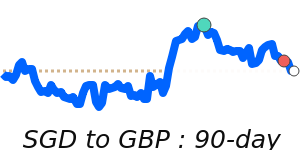

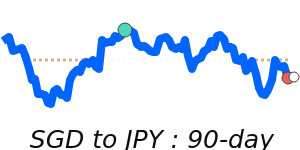

The SGD to GBP exchange rate has remained relatively stable at 0.5729, only marginally below its three-month average of 0.5759. This stability presents a contrast to the movements seen in other currency pairs. Additionally, the SGD to JPY has seen a slight decline, reaching 7-day lows around 113.1, yet remains above its three-month average at 111.2, indicating that the SGD is holding steady against the Japanese Yen within defined trading limits.

With the Monetary Authority of Singapore’s careful management of the SGD against a basket of major currencies, market participants are advised to stay informed about ongoing trade developments, as these could significantly impact exchange rates and international transaction costs in the coming weeks.