Outlook

The SGD is likely to remain modestly constructive in the coming months as MAS keeps policy neutral and domestic growth stays resilient. A higher inflation forecast adds price pressures but does not prompt an immediate policy shift. Upgraded growth expectations and the June Expo Real Asia Pacific 2026 may support the SGD via stronger investment and demand, while a data line that stays firm would help keep SGD options open.

Key drivers

- MAS held its policy band steady; inflation forecast for 2026 was raised, signaling pricing pressure but no tightening yet.

- MTI raised 2025 growth and lifted the 2026 outlook, underscoring a brighter domestic demand backdrop.

- Expo Real Asia Pacific 2026 in Singapore could bring investment and trade activity that support the SGD.

- Domestic momentum and contained price dynamics suggest a balanced near-term path, with moves tied to data and policy guidance.

Range

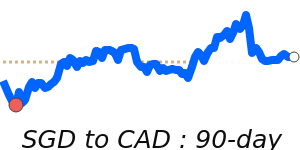

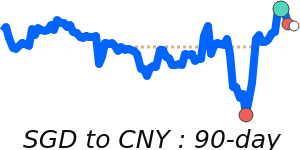

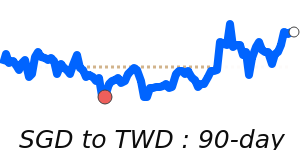

SGD/USD around 0.7829 (30-day low), near the 3-month average; range roughly 0.7706 to 0.7934.

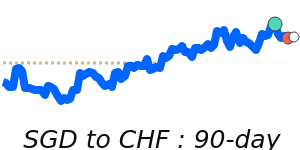

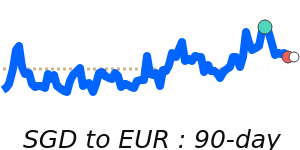

SGD/EUR around 0.6745 (90-day high), ~1.4% above 3‑month average; range roughly 0.6593 to 0.6745.

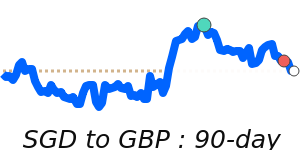

SGD/GBP around 0.5866 (90-day high), ~1.2% above 3‑month average; range roughly 0.5730 to 0.5866.

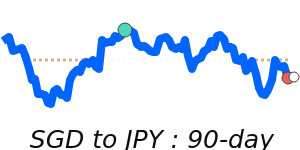

SGD/JPY around 123.6; ~1.3% above 3-month average; range roughly 119.6 to 123.8.

What could change it

- A shift in MAS policy or a clearer inflation trajectory that nudges policy.

- A notable change in US rate expectations that moves the USD.

- Recurring strength in Singapore-focused investment or trade flows around the Expo Real Asia Pacific 2026.