The Singapore dollar (SGD) has faced increased pressure following recent announcements from U.S. President Donald Trump regarding tariffs. The imposition of a 10% reciprocal tariff on Singapore imports has contributed to a negative outlook for the SGD, reflecting broader concerns of a global trade war that have been impacting emerging Asian currencies.

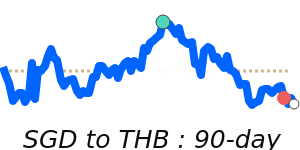

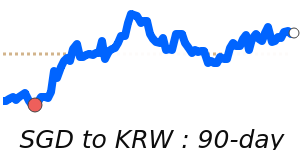

Analysts note that regional currencies, including the SGD, have experienced volatility as market sentiment has soured. The Thai baht and South Korean won have both declined approximately 2%, indicating a shift away from risk appetite amongst investors. This trend has resulted in a reversal of some of the earlier January gains seen in Asian currencies, particularly as several regional central banks opt for interest rate cuts to stimulate economic growth.

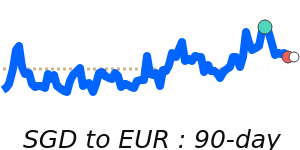

In terms of recent price movements, the SGD to USD exchange rate stands at 0.7857, significantly above its three-month average of 0.7699, representing a 2.1% increase. The SGD has remained relatively stable within a 6.4% range, fluctuating between 0.7388 and 0.7864. Conversely, the SGD to EUR is currently at 90-day lows near 0.6654, which is 1.7% below its three-month average of 0.6775, having held a steady range from 0.6654 to 0.6906.

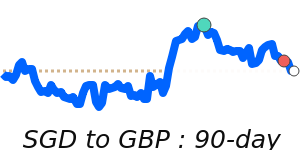

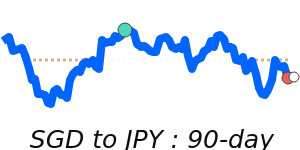

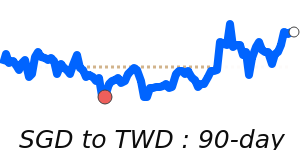

The SGD to GBP exchange rate is at 0.5717, just 0.7% below its three-month average of 0.5758, indicative of consistent trading within a range of 0.5685 to 0.5829. Meanwhile, the SGD to JPY is at recent lows of 112.7, slightly above its three-month average of 111.2, maintaining a stable range from 108.0 to 113.8.

Given that the U.S. is Singapore's largest trading partner, accounting for 15% of total trade, any fluctuations in the SGD could have significant implications for businesses engaged in international transactions. The Monetary Authority of Singapore actively manages the SGD against a basket of currencies from major trading partners, highlighting the importance of currency stability in maintaining trade relations. Ultimately, ongoing developments in trade negotiations and economic policies will be crucial in determining the future direction of the SGD.