The South African Rand (ZAR) is currently experiencing notable volatility, largely driven by external factors including trade relations and investor sentiment. Recently, the United States imposed a 30% reciprocal tariff on South African goods, a move analysts suggest is part of a broader trade conflict. This development could have significant implications for South Africa's economic stability, particularly as it depends heavily on foreign investment to address its budget and current account deficits.

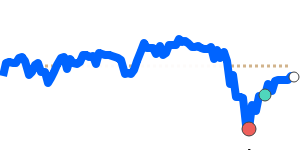

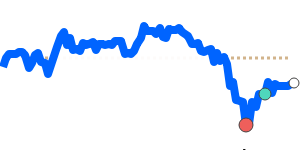

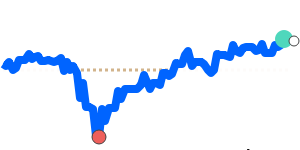

Recent data shows that the ZAR to USD exchange rate is currently at 90-day highs, trading near 0.056472. This figure represents a 3.2% increase over its three-month average of 0.054728. The ZAR/USD pair has exhibited considerable volatility, having fluctuated within an 11.7% range from 0.050563 to 0.056472, reflecting shifting market sentiments.

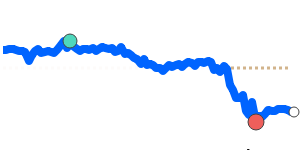

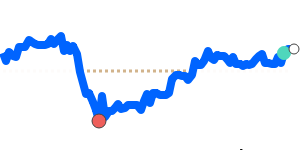

For the ZAR to EUR, the current rate stands at 0.047890, which is only 0.6% lower than its three-month average of 0.048202. This pair has also demonstrated volatility, trading within a fairly broad range of 9.0%, from 0.045978 to 0.050138.

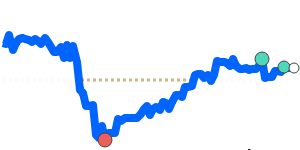

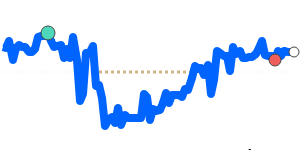

Meanwhile, the ZAR to GBP is at 0.041105, just above its three-month average. This pair has remained relatively stable, operating within a more modest range of 5.7%, between 0.039609 and 0.041873.

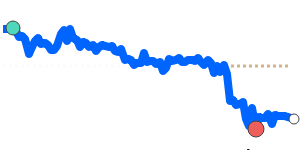

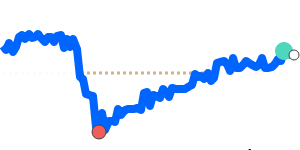

Additionally, the ZAR to JPY is currently at 8.1108, which is 2.6% higher than its three-month average of 7.9089. This currency pair has been quite volatile as well, reflecting a 10.6% trading range from 7.3967 to 8.1817.

Overall, forecasters indicate that the Rand's performance in the near term will be heavily influenced by global economic conditions and domestic stability. Investors will need to monitor these developments closely as they could have significant implications for exchange rates and international transaction costs.