Outlook

The rand looks firmer in 2026 on fiscal consolidation, a credit upgrade, and a stable inflation framework, with energy improvements supporting growth. Near-term moves will hinge on global risk appetite and commodity trends. External risk factors include global growth and commodity prices.

Key drivers

- Fiscal consolidation: Debt ratio path boosting investor confidence and attracting longer-term capital.

- Credit upgrade: This supports risk appetite for SA assets and lowers borrowing costs.

- Inflation framework: A credible framework helps businesses plan pricing and wage decisions.

- Energy improvements: This supports production and transport, easing cost pressures.

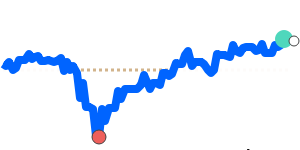

Range

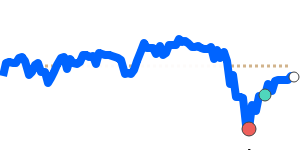

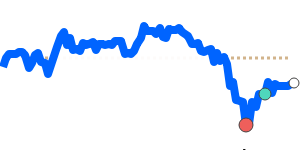

ZAR/USD: 0.06118; near 3-month average; range 0.05862–0.06355.

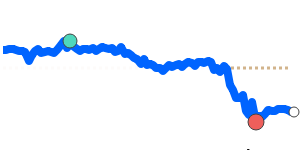

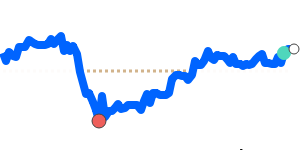

ZAR/EUR: 0.05260; 1.1% above 3-month avg; range 0.05042–0.05337.

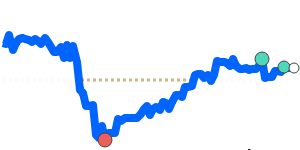

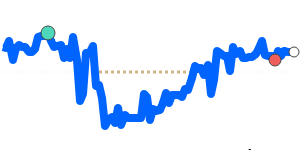

ZAR/GBP: 0.04578; 1.0% above 3-month avg; range 0.04404–0.04659.

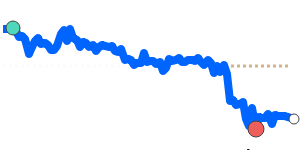

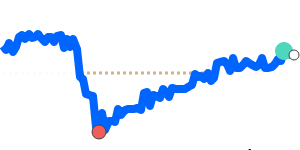

ZAR/JPY: 9.6045; 0.6% above 3-month avg; range 9.1273–9.8580.

Notes: These moves sit within a limited corridor for now.

What could change it

- Fiscal trajectory: Clear debt path could lift the rand.

- Policy surprises: Inflation prints or signals may shift rates expectations significantly.

- External factors: Commodity prices and USD moves affect risk appetite.

- Energy progress: Further improvements in energy supply would support the rand.