DKK & SEK - Markets & outlook

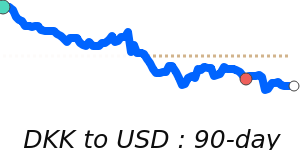

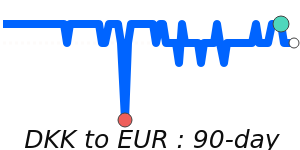

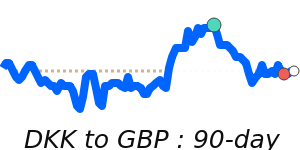

Danish krone - DKK:

Danish krone - DKK:

The Danish kroner (DKK) is fixed to the Euro so the EURDKK exchange rate should not fluctuate very much. The fixed exchange rate policy provides Danish businesses and consumers with greater stability and predictability in their financial transactions, particularly those involving international trade and investment. It reduces the risks associated with fluctuations in currency values, which can be particularly important for small, export-oriented economies like Denmark. However, the policy also limits the flexibility of the Danish central bank to adjust interest rates or implement other monetary policies in response to changing economic conditions, as it must maintain the exchange rate within the agreed-upon range. In recent years, Denmark has faced challenges in maintaining the fixed exchange rate policy, particularly in the face of currency fluctuations and changes in interest rates in other countries, which have required the DNB to intervene frequently in currency markets.

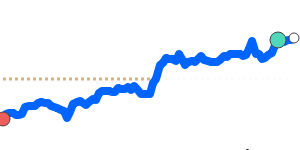

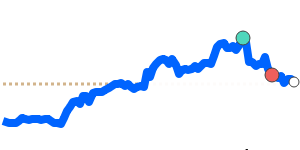

Swedish krona - SEK:

Swedish krona - SEK:

Sweden’s central bank has left the door wide open to a May rate cut should inflation data continue to look better. We now think the Riksbank will move a month earlier than the ECB, where we expect the first cut in June. However, markets are already betting on a May move, and domestic monetary policy should remain secondary to external drivers for SEK.

In what would be a major policy shift for one of the world's most cautious monetary authorities, the governor of Sweden's central bank left the door open for the Riksbank to raise interest rates as soon as this year.

Finishing their economic recovery, the Nordic nation has now found themselves experiencing inflation.