New Zealand dollar (NZD) Market Update

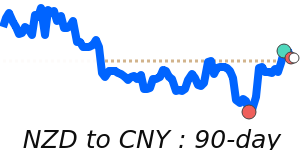

The New Zealand dollar (NZD) is currently experiencing uncertainty amid recent geopolitical developments and fluctuating trade sentiments. A significant factor influencing this volatility includes the announcement by U.S. President Donald Trump of a 10% tariff on imports from New Zealand, an action that echoes similar measures aimed at other major economies. Analysts caution that another Trump presidency could lead to even stricter tariffs on key trading partners, specifically Europe and China, which may dampen demand for New Zealand's essential commodities and further weigh on the NZD.

Recent market performance reflects this tension, with the NZD to USD pair trading at 14-day lows near 0.5900, which is 2.2% above its three-month average of 0.5776. This pair has demonstrated significant volatility, spanning a range of 8.5% from a low of 0.5534 to a high of 0.6007. The New Zealand dollar's correlation with the Australian dollar (AUD) remains prominent, as both currencies frequently move in tandem due to their geographic proximity and reliance on commodity markets.

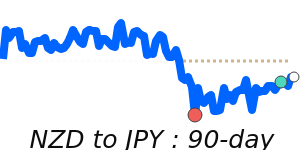

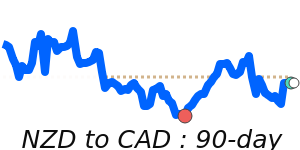

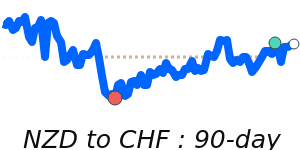

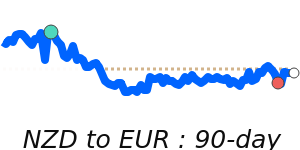

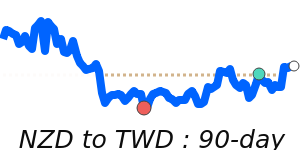

In terms of other key currency pairs, the NZD to EUR rate is at 0.5256, just 0.8% below its three-month average of 0.53, having oscillated within an 8.7% range from 0.5051 to 0.5489. The NZD to GBP rate stands at 0.4457, which aligns closely with its three-month average amid a relatively stable 5.4% movement range. The NZD to JPY pair is currently at 86.12, 1.1% above its three-month average of 85.18, also reflecting steadiness with a range fluctuating from 80.96 to 87.35.

The outlook for the NZD will likely continue to be influenced by global risk dynamics, especially as economic data releases from New Zealand remain sparse. Investors are advised to stay alert to developments in trade relations and further announcements from governing bodies that could impact currency value in the near future.