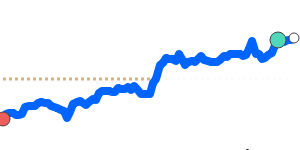

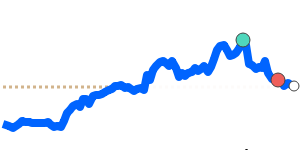

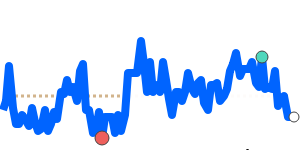

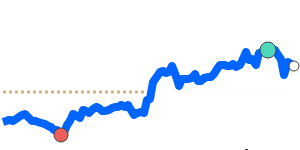

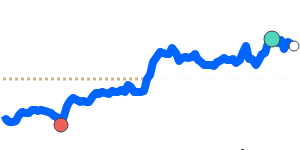

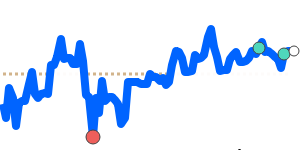

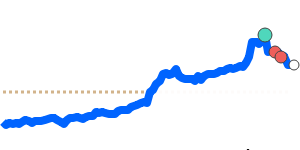

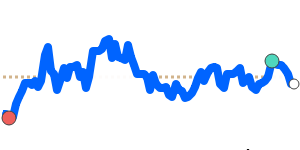

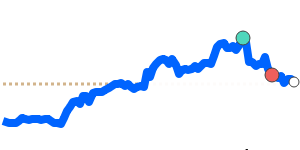

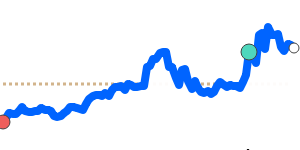

USD/SEK Outlook:

The USD/SEK is slightly positive but likely to move sideways as it remains just above its 90-day average and within its mid-range. ING Bank view indicates USD/SEK could see a larger downside potential below 8.50 this year.

Key drivers:

• Rate gap: The US central bank is signaling a more cautious approach compared to the Swedish central bank, which supports SEK strength.

• Risk/commodities: Oil prices remain volatile, and declining oil prices typically weaken the SEK, impacting its value against the USD.

• Macro factor: A projected uptick in US jobless claims could dampen USD demand, reflecting concerns over the US economy.

Range:

USD/SEK is likely to hold within its recent range, with potential for minor fluctuations.

What could change it:

• Upside risk: A sudden escalation in Middle Eastern conflict may boost USD as a safe haven.

• Downside risk: Strong economic indicators from Sweden could lead to SEK appreciation against the USD.