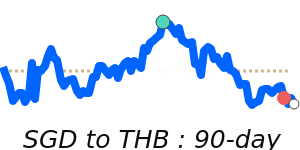

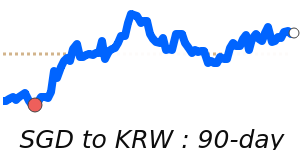

The Singapore dollar (SGD) is currently facing pressure due to heightened trade tensions following recent tariff announcements by U.S. President Donald Trump. The imposition of a 10% tariff on imports from Singapore, as part of broader retaliatory measures against multiple countries, has raised concerns among analysts regarding the outlook for emerging Asian currencies. Consequently, regional currencies experienced declines, with significant movements noted in currencies like the Thai baht and South Korean won.

Despite Singapore's relatively fortunate position within this trade conflict—thanks to its open economy and strong trade connections with the U.S.—the direct impact of the tariff has been felt across the market. Analysts suggest that the Singapore dollar's resilience is notable given that the U.S. remains Singapore's largest trading partner, accounting for 15% of total trade. However, the overall sentiment in the market remains cautious as fears of a global trade war continue to erode risk appetite among investors.

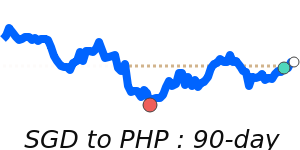

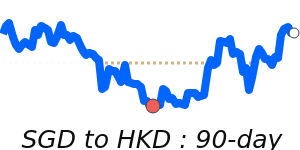

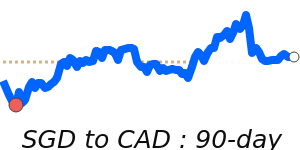

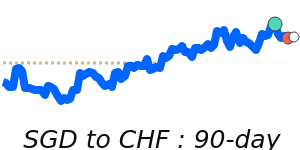

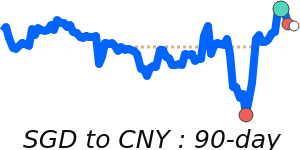

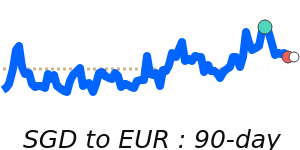

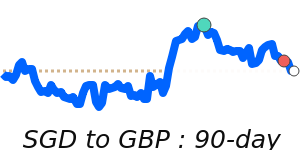

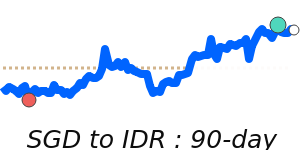

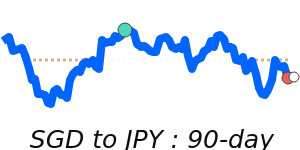

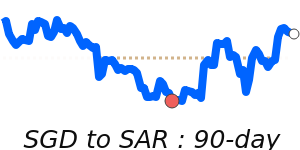

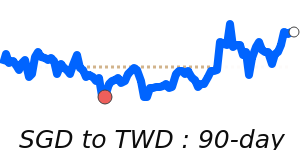

Currently, the SGD is trading at 0.7789 against the U.S. dollar, which is slightly above its three-month average of 0.7749. This reflects a stable trading range of 3.5% from a low of 0.7598 to a high of 0.7864. In comparison, the exchange rate against the Euro is at 0.6696, sitting 1.0% below its three-month average of 0.6764, within a range of 0.6654 to 0.6906. The SGD to GBP pair stands at 0.5810, a mere 0.9% above its three-month average of 0.5759, maintaining stability within a 2.5% range. Conversely, the SGD has shown stronger performance against the yen, trading at 115.4, which is 2.9% above its three-month average of 112.1, with a broader range of 108.0 to 115.8.

Forecasters indicate that the situation remains fluid, with currency movements likely influenced by further developments in trade policies and potential adjustments by the Monetary Authority of Singapore (MAS). The MAS values the SGD against a basket of currencies to support its managed approach, which could play a critical role in stabilizing the currency amid ongoing global uncertainties. As such, stakeholders in international transactions should remain vigilant and consider hedging strategies to mitigate potential forex risks.