Some Recent Articles written by David:

Currency Market Update - Week ending 2026-02-08

Read more

Japan Travel Boom: Weak Yen Makes Winter Trips Exceptional Value

Read more

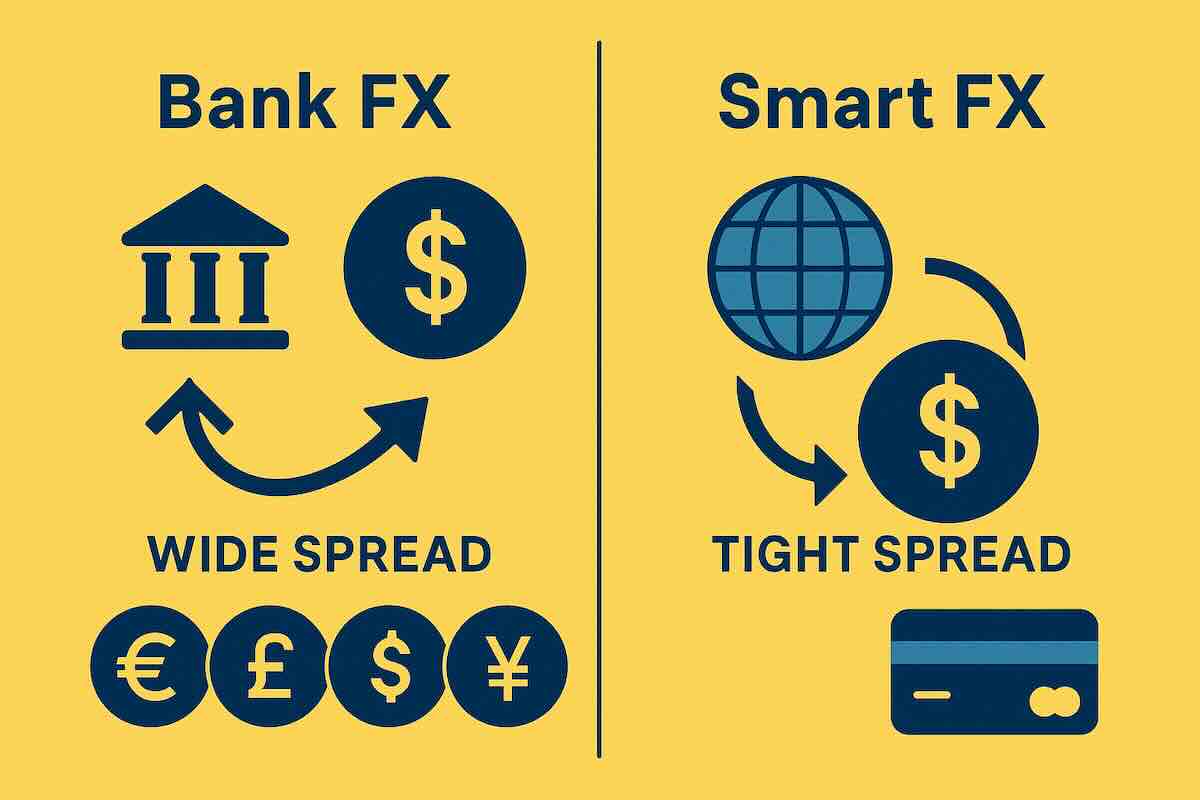

The Most Expensive FX Mistakes People Make

Read more

Australian Dollar Outlook: RBA–Fed Split Could Drive AUD Higher

Read more

How to Receive Freelance Payments from Abroad and Save on Exchange Rates

Read more

Nepal Raises Daily Remittance Limit to NPR 2.5 Million

Read more

Wise vs Revolut (USA): Transfers & Travel in 2025

Read more

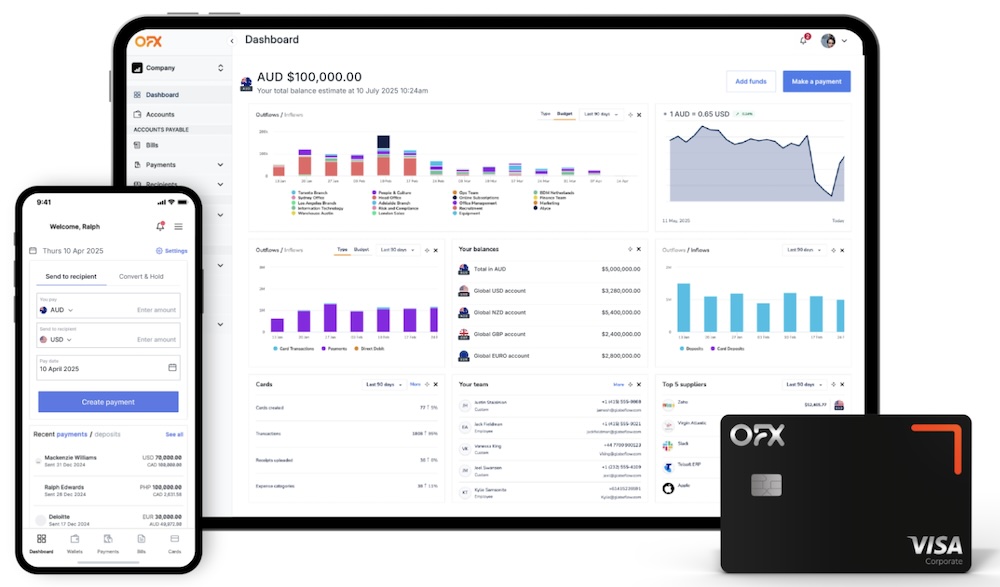

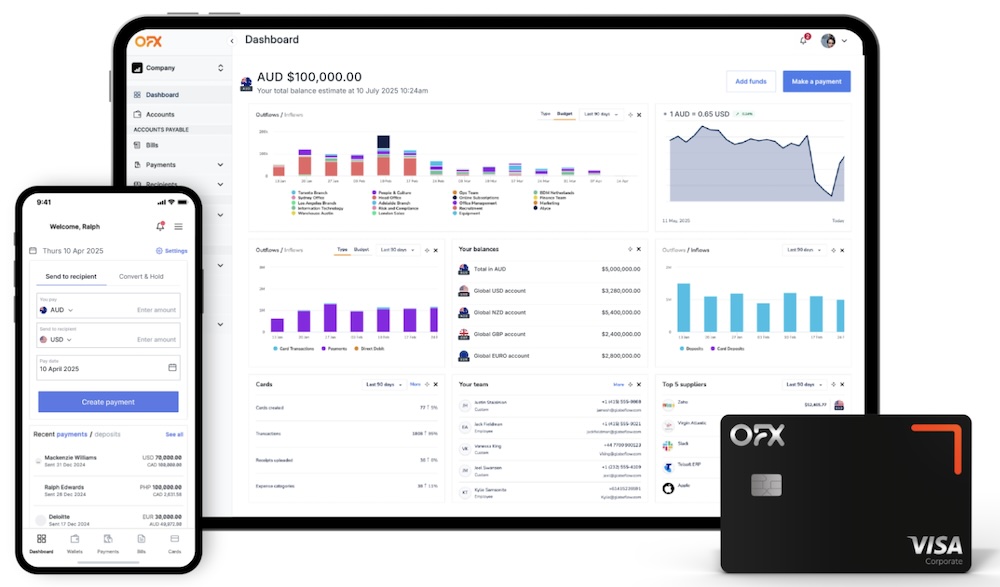

OFX 2.0 for Business: Global Accounts, Cards & Spend Control

Read more

Global Central Banks Shift Policy: Key FX Impacts for August 2025

Read more

Revolut rolls out eSIM, Mobile Plans, RevPoints boosts and UK trading

Read more

Trump Imposes Broad Tariff Hikes as Global Trade Tensions Escalate

Read more

USD/MXN Dips as Mexico Wins 90‑Day Tariff Reprieve

Read more

If you would like to write for BER or want to contact us or one of our authors please visit our contact page.

Please note that the opinions of our authors are their own and do not reflect the opinion of Best Exchange Rates and should not be taken as a reference to buy or sell any financial product.