![]()

![]() Recent analysis from currency market experts indicates that the GBP to DKK exchange rate is facing headwinds due to a combination of political and economic factors affecting the British pound. Following U.S. President Donald Trump's announcement of a 10% tariff on UK imports, the pound has struggled against the majority of its currency peers. Analysts attribute this weakness to growing disappointment around the prospects of a UK-US trade deal, particularly as reports suggest that the U.S. is focusing its trade efforts on Asian economies, relegating the UK to a “second-order priority.”

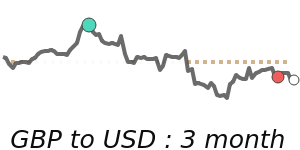

Recent analysis from currency market experts indicates that the GBP to DKK exchange rate is facing headwinds due to a combination of political and economic factors affecting the British pound. Following U.S. President Donald Trump's announcement of a 10% tariff on UK imports, the pound has struggled against the majority of its currency peers. Analysts attribute this weakness to growing disappointment around the prospects of a UK-US trade deal, particularly as reports suggest that the U.S. is focusing its trade efforts on Asian economies, relegating the UK to a “second-order priority.”

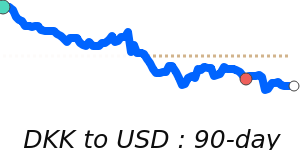

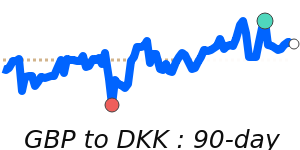

Current data shows the GBP to DKK trading at around 8.7787, which is approximately 1.0% below its three-month average of 8.871. This indicates that the pound has been relatively stable within a 5.2% range from 8.5991 to 9.0442. However, the uncertainty surrounding the upcoming local elections in the UK could further contribute to GBP volatility. If the Labour Party performs poorly, it could raise concerns about the government's stability and the overall economic recovery, leading to potential depreciation of the pound.

The value of the GBP continues to be influenced by key economic indicators, monetary policy from the Bank of England, and the political landscape post-Brexit. Since the UK's exit from the EU, the pound has experienced increased volatility, making it sensitive to events such as trade negotiations and economic data releases. Forecasters suggest that the pound's trajectory will largely depend on investor confidence, foreign investment dynamics, and evolving trade relationships as the UK seeks to firmly establish its position in the global market.

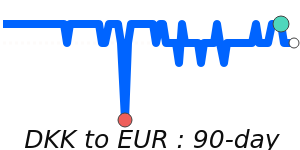

On the other hand, the Danish kroner (DKK), being fixed to the Euro, offers a degree of stability that is beneficial for Danish businesses, particularly in international trade. This fixed exchange rate policy mitigates risks associated with currency fluctuations, although it does limit monetary policy flexibility for the Danish central bank. Overall, as the market navigates this evolving landscape, both GBP and DKK will be closely watched by traders seeking to optimize their international transactions.

Loading rates...

|

|

|

DKK to GBP Market Data

Danish krone (DKK) to British pound (GBP) market data - latest interbank exchange rate, trend, chart & historic rates.

Compare & Save - Danish krone to British pound

Exchange rates can vary significantly between different currency exchange providers, so it's important to compare Danish krone (DKK) to British pound (GBP) rates from different sources before making a conversion.

Use our DKK to GBP calculator to see how much you could save on your international money transfers. makes it easy to compare the Total Cost you are being charged on Krone to Sterling currency rates and the possible savings of using various providers.

| Date | DKK/GBP | Period |

|---|---|---|

12 Apr 2025 | 0.1162 | 2 Week |

26 Jan 2025 | 0.1126 | 3 Month |

26 Apr 2024 | 0.1149 | 1 Year |

27 Apr 2020 | 0.1169 | 5 Year |

29 Apr 2015 | 0.0962 | 10 Year |

01 May 2005 | 0.0912 | 20 Year |

Will the Danish krone rise against the British pound?

It is almost impossible to predict what an exchange rate will do in the future, the best approach is to monitor the currency markets and transact when an exchange rate moves in your favour.

To help with this you can add DKK/GBP to your personalised Rate Tracker to track and benefit from currency movements.

Rather than requiring you to set a target rate, our Rate Alerts keep you informed of recent trends and movements of currency pairs.

Add rates to your Rate Tracker and select to receive an daily email (mon-fri) or when a rate is trending

Related exchange rate forecasts

BER articles that mention the British pound (GBP):

The U.S. Dollar Is Losing Ground to the Euro — And the World Is Watching

Deutsche Bank forecasts a significant weakening of the US dollar in the coming years, potentially reaching its lowest level against the euro in over a decade.

Wise Review: Is It the Best Way to Transfer Money Internationally?

The Wise Account allows users to hold and convert funds in 40 different currencies and send and spend internationally, all at the “real” exchange rate and with exceptionally low service fees. Users can also receive major-currency payments free of charge.

Global Currency Markets React to U.S. Tariffs and Economic Policies

Recent U.S. trade policies, including aggressive tariffs on auto imports, have introduced significant volatility in global currency markets, affecting major currencies such as the euro, British pound, and Japanese yen.

Further reading on the British pound (GBP) - Guides, Reviews & News from our research team.

Forecasts disclaimer: Please be advised that the forecasts and analysis of market data presented on BestExchangeRates.com are solely a review and compilation of forecasts from various market experts and economists. These forecasts are not meant to reflect the opinions or views of BestExchangeRates.com or its affiliates, nor should they be construed as a recommendation or advice to engage in any financial transactions. Read more