INR to CAD Market Data

Indian rupee (INR) to Canadian dollar (CAD) market data - latest interbank exchange rate, trend, chart & historic rates.

What are equivalent amounts of INR and CAD?

Here are some popular conversion amounts for INR to CAD (Indian rupee to Canadian dollar)*.

*Converted at the current INRCAD interbank exchange rate. Calculate actual payout amounts for Send Money and Travel Money exchange rates.

Read our full review of recent INR to CAD forecasts.

How to get a good INR to CAD exchange rate

There are several ways to save on exchange rates when converting Indian rupee to Canadian dollar:

- Shop around for the best INR/CAD exchange rate: Exchange rates can vary significantly between different currency exchange providers, so it's important to compare rates from different sources before making a conversion.

- Timing is important: Keep an eye on the INR/CAD rate on currency markets, as exchange rates can fluctuate frequently. Try to make your transactions when the exchange rate is in your favor. You can do this easily with our BER Smart Rate Tracker.

- Use a credit/debit or travel card that doesn't charge foreign transaction fees: Some credit cards charge additional fees for transactions made in a foreign currency, so it's important to check with your card issuer to see if they charge these fees and what their exchange rate is.

- Use a multi-currency account: Having a multi-currency account allows you to hold and transfer money in both INR and CAD at close to the interbank rate. It also allows you to make payments or withdrawals in the local currency while avoiding high conversion fees.

- Buy currency in advance: If you know that you will need foreign currency in the future, consider buying it in advance when the exchange rate is favorable.

The key is reducing excessive costs and fees

Generally speaking, if you are buying Canadian dollar with Indian rupee, then it's better for the INR/CAD exchange rate to be higher.

However working against you are the fees all foreign exchange providers charge for providing their service. These fees is usually contained within the exchange rate margin (or difference to the mid-rate).

The transaction margin you end up being charged can be considerably reduced by around a few percent (of total amount being exchanged) for travel money and possibly over 5% to 6% when sending money. The exact potential savings depends on the currencies being exchanged and the amount you are transferring and if you are willing to shop around.

Our real-time foreign transfer and travel money/cards comparison calculators make shopping around easy and help you calculate how much you can save.

Read our Currency guide to Canada ![]() — a practical currency and money guide to travel in Canada plus living and doing business with the Canadian dollar.

— a practical currency and money guide to travel in Canada plus living and doing business with the Canadian dollar.

It's worth noting that while these tips can help you save on exchange rates, it's important to be aware that no single method is guaranteed to provide the best exchange rate in every situation, and it may require some research and comparison-shopping to find the best option for your specific needs.

Will the Indian rupee rise against the Canadian dollar?

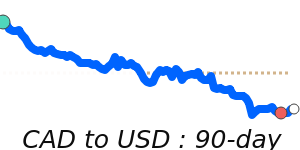

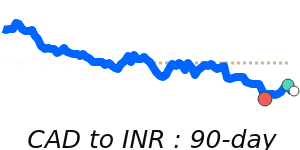

This is always a difficult question as exchange rates are influenced by many factors, so a good method to consider the Indian rupee vs Canadian dollar current value is to look the INR/CAD historic rate and change over a range of periods.

The following table looks at the change in the INR to CAD exchange rate over periods from the previous week back to the last 10 years.

| Date | INR/CAD | Period |

|---|---|---|

07 Jun 2025 | 0.0160 | 2 Week |

23 Mar 2025 | 0.0167 | 3 Month |

21 Jun 2024 | 0.0164 | 1 Year |

22 Jun 2020 | 0.0178 | 5 Year |

24 Jun 2015 | 0.0195 | 10 Year |

26 Jun 2005 | 0.0283 | 20 Year |

It is almost impossible to predict what an exchange rate will do in the future, the best approach is to monitor the currency markets and transact when an exchange rate moves in your favour.

To help with this you can add INR/CAD to your personalised Rate Tracker to track and benefit from currency movements.

Rather than requiring you to set a target rate, our Rate Alerts keep you informed of recent trends and movements of currency pairs.

Add rates to your Rate Tracker and select to receive an daily email (mon-fri) or when a rate is trending

Currency Country Guides

India (INR) India (INR) |  Canada (CAD) Canada (CAD) |

Here are a few things to consider when sending money to Canada:

Fees: Different banks and money transfer services charge different fees for international money transfers. Shop around to find the best deal and compare the fees charged by different providers.

Exchange rate: The exchange rate is the rate at which one currency is converted into another. Keep an eye on the exchange rate when sending money to Canada, as it can fluctuate and impact the amount of money you receive.

Transfer speed: Some money transfer providers offer faster transfer speeds than others. If you need the money to arrive in Canada quickly, consider a provider that offers expedited transfer speeds for an additional fee.

Transfer limits: Most banks and money transfer providers have limits on the amount of money you can send in a single transaction. Check with your provider to find out what the limits are and whether you'll need to send multiple transactions to send the amount you need.

Security: Make sure to use a reputable and secure provider when sending money to Canada. Look for a provider that uses encryption to protect your personal and financial information.

Read more at our Canada (CAD) country guide

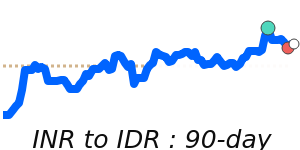

Related exchange rates

Forecasts disclaimer: Please be advised that the forecasts and analysis of market data presented on BestExchangeRates.com are solely a review and compilation of forecasts from various market experts and economists. These forecasts are not meant to reflect the opinions or views of BestExchangeRates.com or its affiliates, nor should they be construed as a recommendation or advice to engage in any financial transactions. Read more

^ Scroll back up to ^

^