Explore our latest CAD tagged content. From expert guides and forecasts to provider reviews and practical money tips, these posts help you stay informed and make smarter currency decisions.

All Content (171)

By Topic:

About Us (11)

Africa (1)

Banks (1)

Business (1)

Business Fx Specialists (11)

Crypto (1)

Expat (11)

Foreign Currency Accounts (11)

Foreign Transfers (31)

Fx Analysis (5)

Fx Risk (6)

Fx Specialists (23)

Large Amounts (11)

Ofx (12)

Online Sellers (1)

Popular (3)

Property (2)

Pursuits (1)

Revolut (8)

Study Abroad (7)

Travel (1)

Travel Cards (9)

Travel Money (12)

Wise (13)

By Currency: AED (28) AFN (1) ALL (1) AMD (1) ANG (2) AOA (1) ARS (2) AUD (71) AWG (1) AZN (1) BAM (1) BBD (1) BDT (1) BHD (1) BIF (1) BMD (1) BND (1) BOB (1) BRL (6) BSD (1) BTC (1) BTN (1) BWP (1) BZD (1) CAD (49) CDF (1) CHF (33) CLP (4) CNY (22) COP (1) CUP (1) CVE (1) CZK (5) DJF (1) DKK (9) DOP (1) DZD (1) EGP (2) ETB (1) EUR (114) FJD (6) FKP (1) GBP (71) GEL (1) GHS (2) GIP (1) GMD (1) GNF (1) GTQ (1) GYD (1) HKD (22) HNL (1) HTG (1) HUF (5) IDR (8) ILS (6) INR (31) IQD (1) IRR (1) ISK (1) JMD (1) JOD (1) JPY (31) KES (2) KGS (1) KHR (1) KMF (1) KPW (1) KRW (4) KWD (1) KYD (1) KZT (1) LAK (2) LBP (1) LKR (2) LRD (1) LSL (1) LYD (1) MAD (2) MDL (1) MGA (1) MKD (1) MMK (2) MNT (1) MOP (1) MRO (1) MUR (1) MVR (1) MWK (1) MXN (13) MYR (23) MZN (1) NAD (1) NGN (6) NOK (8) NPR (2) NZD (39) OIL (1) OMR (4) PEN (1) PGK (1) PHP (13) PKR (12) PLN (8) PYG (1) QAR (7) RON (2) RSD (1) RUB (8) RWF (1) SAR (9) SBD (4) SCR (1) SDG (1) SEK (9) SGD (38) SHP (1) SLL (1) SOS (1) SRD (1) SYP (2) SZL (1) THB (16) TJS (1) TMT (1) TND (1) TOP (1) TRY (8) TTD (1) TWD (12) TZS (1) UAH (2) UGX (2) USD (112) UYU (1) UZS (1) VEF (1) VND (11) VUV (1) WST (6) XAF (9) XCD (10) XOF (11) XPF (7) YER (1) ZAR (11) ZWL (1)

Guide to the Canadian Dollar (CAD): Travel, Transfers & FX Tips

The Canadian dollar (CAD) is a major global currency closely linked to commodities and US trade. This guide explains how it works and how to manage CAD FX costs.

Currency Market Update - Week ending 2026-03-01 2026-02-23

Weekly currency market update—practical actions for SMBs, expats and travellers across AUD, CAD, GBP, NZD, SGD, USD, EUR and JPY

Japan Travel Boom: Weak Yen Makes Winter Trips Exceptional Value 2025-12-23

With the yen down sharply against major currencies, winter in Japan offers rare value on hotels, food, transport, and skiing. A rare currency tailwind for travellers.

Global Central Banks Shift Policy: Key FX Impacts for August 2025 2025-08-28

Central banks are moving in different directions—Australia cuts, UK eases despite inflation, and the Fed faces political risks. Here’s what it means for exchange rates and transfer timing.

Trump Imposes Broad Tariff Hikes as Global Trade Tensions Escalate 2025-08-02

President Trump has raised U.S. tariffs to an average of 15.2%, targeting Canada, Asia, and Europe, as part of his push to reshape global trade. Markets and currencies reacted with caution amid rising uncertainty.

Dollar Surges, Rupee Stumbles: What's Driving FX Markets Now 2025-07-30

Global FX markets shifted in July as the USD gained on trade deals, the British pound climbed, and the Indian rupee weakened on tariff fears. Here’s what’s driving currencies now.

Loonie Resilience Defies Odds Amid Carney Election and Trade Tensions 2025-04-29

The Canadian dollar has defied political chaos and global headwinds to emerge as one of 2025’s unlikely winners. But with minority rule in Ottawa, soaring household debt, and a high-stakes U.S. election looming, the loonie’s fight for survival is just beginning.

Currency Markets in Flux: Euro's Ascent Amidst Global Economic Shifts 2025-03-19

The global currency landscape is experiencing notable shifts as the euro strengthens against major currencies, influenced by economic policies, geopolitical events, and fluctuating oil prices.

Where to for the Loonie in 2025

Economists are predicting that the Canadian dollar could rise this year.

Will the US dollar remain strong?

The dollar has risen by nearly 20% against most currencies compared to this time last year.

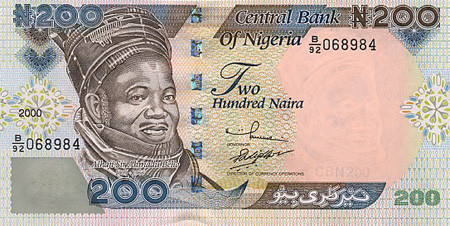

Nigeria's Decision to End Currency Peg Triggers Historic Naira Plunge 2023-06-20

Central Bank Chief's Removal Sets Stage for Currency Liberalization

US Dollar Weakens on Regional Banks Fears and Tighter Credit 2023-05-05

The US dollar weakened due to fears surrounding regional banks, while the ECB offered a less hawkish than expected 25bp hike and the Swiss franc is in demand.

Ski vacations and exchange rates

How can exchange rates affect the cost of a ski holiday? We look at tips for finding the best value locations for skiing, there are countries where skiing may be more affordable due to favourable exchange rates or lower costs of living.

Fears of US Recession Shifts Currencies & Commodities 2022-06-23

As we approach mid-year a shift has taken place in currency markets with the narrative less about interest rates hikes and more risk-off worries about a possible coming recession.

Russian sanctions mount - US dollar gains 2022-02-28

Any curbs to Russian access to its foreign reserves could present a bigger blow to the Russian economy than the impact of a ban on Swift.

Canada Country Guide (CA)

Canada is a vast country with a lot to see and do, so it's a good idea to spend some time planning your trip to make the most of your time there. Here are some things you might consider when planning a trip to Canada:

Planning a t...

CAD to ZAR Rates - 2026 Forecast

CAD/ZAR Outlook: The CAD/ZAR exchange rate is likely to decrease as it currently trades significantly below its recent average and is near recent lows.

CAD to TWD Rates - 2026 Forecast

CAD/TWD Outlook: The outlook for CAD/TWD is slightly weaker, but likely to move sideways, as the rate is below its recent average and near the lower end of its 3-month range.

CAD to THB Rates - 2026 Forecast

CAD/THB Outlook: The CAD/THB rate is slightly weaker but likely to move sideways as it is just below its recent average and near mid-range.

CAD to SGD Rates - 2026 Forecast

CAD/SGD Outlook: The CAD/SGD exchange rate is likely to decrease as it is currently near recent lows and below its 90-day average.

CAD to PKR Rates - 2026 Forecast

CAD/PKR Outlook: The CAD/PKR rate is likely to move sideways, as it is currently near its 90-day average and within a stable range.

CAD to PHP Rates - 2026 Forecast

CAD/PHP Outlook: The CAD/PHP is slightly weaker, trading below its recent average and within a stable range.

CAD to NZD Rates - 2026 Forecast

CAD/NZD Outlook: The CAD/NZD exchange rate is likely to decrease, as it is trading significantly below its recent average and is positioned near its recent lows.

CAD to MYR Rates - 2026 Forecast

CAD/MYR Outlook: The CAD/MYR exchange rate is likely to decrease as it trades significantly below its recent average and is near recent lows, influenced...

CAD to MXN Rates - 2026 Forecast

CAD/MXN Outlook: The CAD/MXN exchange rate is likely to decrease as it is currently below its recent average and near recent lows.

CAD to JPY Rates - 2026 Forecast

CAD/JPY Outlook: The CAD/JPY exchange rate is slightly positive but likely to move sideways.

CAD to INR Rates - 2026 Forecast

CAD/INR Outlook: The CAD/INR rate is likely to increase as it trades above its recent average, supported by strong oil price performance.

CAD to ILS Rates - 2026 Forecast

CAD/ILS Outlook: The CAD/ILS exchange rate is likely to decrease as it trades below its recent average and near the lower end of its range.

CAD to HKD Rates - 2026 Forecast

CAD/HKD Outlook: The CAD/HKD exchange rate is slightly positive, but likely to move sideways as it is trading above its recent average and near the upper...

CAD to GBP Rates - 2026 Forecast

CAD/GBP Outlook: The CAD/GBP rate is currently near its 3-month average and has shown stability recently, suggesting a likely sideways movement.

CAD to EUR Rates - 2026 Forecast

CAD/EUR Outlook: The Canadian dollar (CAD) is currently below its recent average and near recent lows, primarily pressured by easing oil prices.

CAD to DKK Rates - 2026 Forecast

CAD/DKK Outlook: The CAD/DKK exchange rate is slightly weaker, but likely to move sideways as it trades near its recent average amid mixed signals from both currencies.

CAD to CZK Rates - 2026 Forecast

CAD/CZK Outlook: The CAD/CZK exchange rate is slightly weaker but likely to move sideways, as it is near its recent average and experiencing mixed signals.

CAD to CNY Rates - 2026 Forecast

CAD/CNY Outlook: The CAD/CNY rate is likely to decrease as it is currently trading below its recent average and near the recent lows.

CAD to CLP Rates - 2026 Forecast

CAD/CLP Outlook: The CAD/CLP rate is currently below its 90-day average and near recent lows, suggesting a bearish outlook.

CAD to CHF Rates - 2026 Forecast

CAD/CHF Outlook: The CAD/CHF exchange rate is currently below its 90-day average and near its recent lows.

CAD to BRL Rates - 2026 Forecast

CAD/BRL Outlook: The CAD/BRL exchange rate is likely to decrease as it is currently trading below its recent average and near recent lows, indicating...

CAD to AUD Rates - 2026 Forecast

CAD/AUD Outlook: The CAD/AUD exchange rate is currently bearish, trading near its recent lows and significantly below its 90-day average.

CAD to AED Rates - 2026 Forecast

CAD/AED Outlook: The CAD/AED rate is slightly positive, reflecting its position above the recent average while being near recent highs.

CAD to USD Rates - 2026 Forecast

CAD/USD Outlook: The CAD/USD exchange rate is slightly positive, but likely to move sideways as it is near its recent average and within a stable range.

AUD to CAD Rates - 2026 Forecast

AUD/CAD Outlook: The AUD/CAD exchange rate is likely to increase as it trades at 90-day highs and is significantly above its recent average.

EUR to CAD Rates - 2026 Forecast

EUR/CAD Outlook: The EUR/CAD exchange rate is likely to move sideways as it hovers near its recent average and shows no clear direction.

GBP to CAD Rates - 2026 Forecast

GBP/CAD Outlook: The GBP/CAD rate is currently trading near its 3-month average and 7-day highs, showing slight bullish momentum.

USD to CAD Rates - 2026 Forecast

USD/CAD Outlook: The USD/CAD exchange rate shows a slightly weaker outlook as it is trading near its recent lows and just below the 90-day average.

CHF to CAD Rates - 2026 Forecast

CHF/CAD Outlook: The CHF/CAD exchange rate is currently slightly positive, but likely to move sideways.

AED to CAD Rates - 2026 Forecast

AED/CAD Outlook: The AED/CAD exchange rate is slightly positive but likely to move sideways as it trades just below its recent average and remains within its mid-range.

NZD to CAD Rates - 2026 Forecast

NZD/CAD Outlook: The New Zealand dollar (NZD) is currently trading above its recent average and is near the higher end of its 3-month range, suggesting a...

INR to CAD Rates - 2026 Forecast

INR/CAD Outlook: The INR/CAD rate is currently below its recent average and has recently hit a 7-day high, indicating a slight recovery.

SGD to CAD Rates - 2026 Forecast

SGD/CAD Outlook: The SGD/CAD exchange rate is slightly positive, trading above its recent average and near recent highs.