The UAE Dirham (AED) remains steady against the US dollar (USD), maintaining its three-month average at 0.2723. This stability comes amidst recent geopolitical tensions following military actions in the region. Analysts note that these developments have fueled increased oil prices, contributing to market volatility in the UAE and surrounding areas.

Economic growth forecasts by the Arab Monetary Fund predict the UAE's economy will expand by 6.2% in 2025, bolstered by improvements in tourism, real estate, and international trade. However, the recent slowdown in the non-oil sector indicates that challenges remain in diversifying the economy. This serves as a reminder that while positive growth is anticipated, sector performance may impact the AED's future value.

Additionally, upcoming trade negotiations with the U.S. seeking to reduce tariffs on steel and aluminum exports could have implications for the UAE's trade balance and consequently influence the Dirham. Optimistically, substantial investments in artificial intelligence signal a strategic push towards economic diversification, which may be favorable for the currency in the long run.

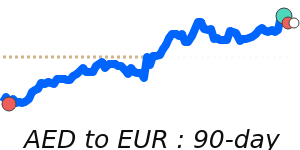

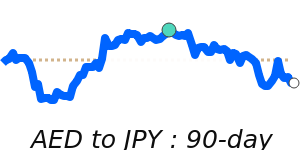

In relation to other currencies, the AED is trading at 14-day highs against the Euro (EUR) at approximately 0.2330, although this reflects a 2.1% dip from its three-month average of 0.238. For GBP, the AED is just below its three-month average at around 0.2017, having maintained a stable trading range. The AED is also performing well against the Japanese yen (JPY), reaching 30-day highs near 40.13, which is 2.1% above the three-month average and demonstrates a stable trading pattern.

These factors suggest that travelers, expats, and business owners engaged in international transactions may want to monitor these developments closely as they could affect the AED's value and thus impact currency conversions.