Outlook

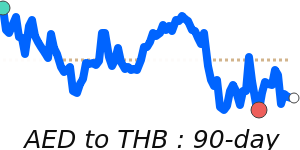

AED remains supported by a solid fiscal stance and ongoing growth projects. The 2026 budget and Dubai Loop infrastructure plans underpin stability. The digital dirham in government transactions could boost efficiency and funding flows. UAE participation at Davos and the March 26 policy conference anchor policy credibility. In the near term, the AED should stay within a tight range as markets digest policy signals.

Key drivers

- Record AED budget for 2026 supports growth and macro stability.

- Dubai Loop and infrastructure plans lift growth prospects.

- Digital dirham adoption in government transactions improves efficiency and funding flows.

- UAE participation at Davos and policy discussions reinforce policy credibility.

- The March 26 monetary policy conference could guide policy signals.

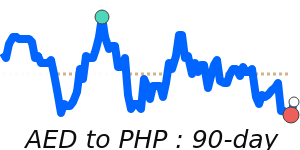

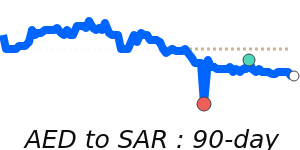

Range

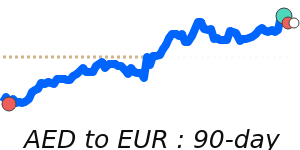

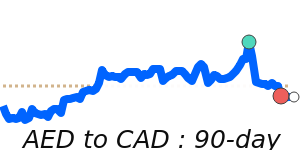

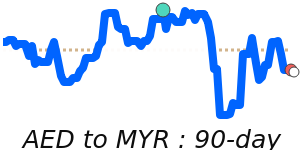

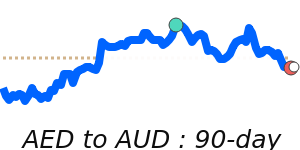

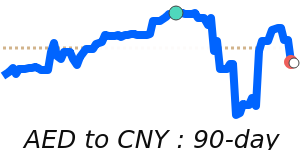

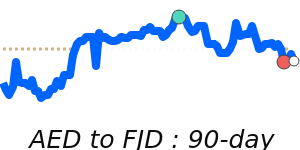

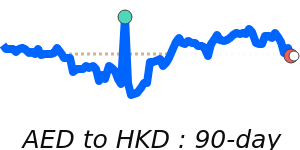

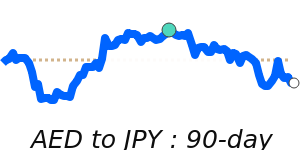

AED/USD steady at 0.2723 on the 3-month average. EUR 0.2342, around 1% above 0.2317; range 0.2263–0.2350. GBP 0.2031, about 0.6% above 0.2018; range 0.1968–0.2047. JPY 42.96, about 1.1% above 42.51; range 41.47–43.32.

What could change it

- Stronger global risk appetite.

- UAE policy signals at the March conference.

- Progress on the digital dirham.