Recent developments in the currency market indicate a steady performance for the UAE Dirham (AED), amid various geopolitical and economic influences. As of mid-June 2025, the exchange rate for AED to USD remains stable at its three-month average of 0.2723, suggesting a consistent value against the US dollar.

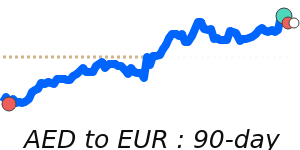

Analysts have noted fluctuations in the AED's performance against the Euro, currently at 0.2322, which is 2.6% below its three-month average of 0.2384. The pair has traded within a relatively stable range of 0.2306 to 0.2486, reflecting the ongoing uncertainty in European markets driven by broader economic conditions. In contrast, the AED to GBP has recently reached 14-day highs near 0.2004, just 1.2% below its three-month average of 0.2028, within a tight trading range of 0.1981 to 0.2122.

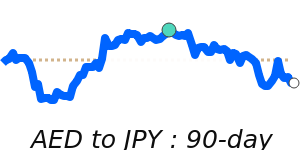

The yen also shows a positive trend, with AED to JPY trading at approximately 39.99, which is at 30-day highs and 1.7% above its three-month average of 39.31, within a 5.4% range from 38.35 to 40.42.

Geopolitical tensions following military strikes by Israel on Iran have led to increased oil prices and market volatility in the region. This could significantly affect investor sentiment towards the AED. The Arab Monetary Fund projects a robust economic growth of 6.2% for the UAE in 2025, bolstered by tourism and international trade improvements. Nonetheless, recent data indicates a slowdown in the non-oil sector's growth, which may challenge the UAE's diversification efforts.

Furthermore, the UAE's pursuit of a trade agreement with the U.S. aimed at reducing tariffs on steel and aluminum exports could impact trade balances and currency dynamics moving forward. Significant investments in artificial intelligence are also being made to bolster future economic resilience.

These multiple factors will likely play a role in the AED's value, making it essential for travelers, expatriates, and businesses engaged in international transactions to stay informed of ongoing developments.