Recent forecasts regarding the USD to DKK exchange rate suggest a mixed outlook, influenced by strong US economic indicators and Denmark's monetary policy stability. Analysts noted a significant uptick in the US dollar, attributed to better-than-expected US job growth in June, where non-farm payrolls rose to 147,000, exceeding forecasts. This was coupled with an unexpected decline in the unemployment rate and a robust ISM services PMI, enhancing the dollar's appeal as a safe-haven currency amidst global uncertainty.

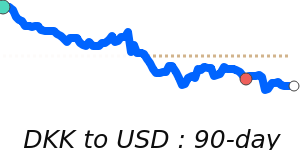

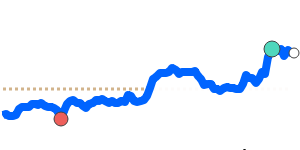

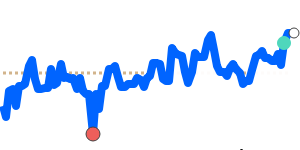

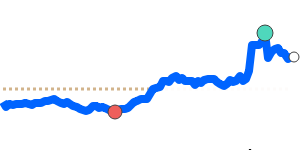

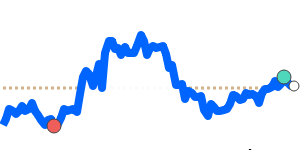

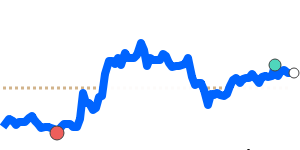

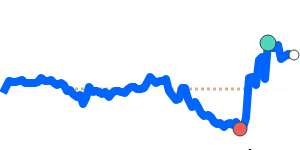

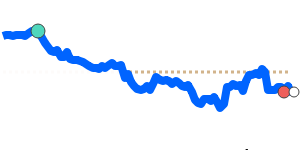

While the USD currently stands at 6.3391, approximately 3.3% below its three-month average of 6.5577, the currency has shown considerable volatility, ranging between 6.3200 to 6.8479. The recent strength of the dollar is expecte to be sustained, especially as the Federal Reserve continues to tweak interest rates based on prevailing economic data, including inflation and GDP growth.

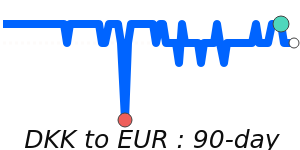

In contrast, the Danish kroner remains relatively stable due to its fixed exchange rate policy with the Euro, which aims to provide predictability for the Danish economy. Economists emphasize that while this policy reduces currency valuation risks, it also limits the Danish central bank's ability to independently adjust interest rates. Recent challenges in maintaining this fixed rate suggest the Danish National Bank may need to intervene more frequently to stabilize the DKK against major currencies.

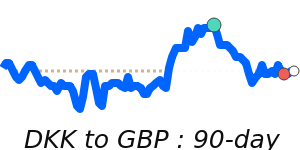

Overall, the USD is experiencing a bullish sentiment in the wake of strong economic fundamentals, while the DKK's stability is rooted in its fixed relation to the Euro. Businesses and individuals involved in international transactions should keep an eye on these dynamics, as fluctuations in the USD could present opportunities or risks in their forex dealings.