Outlook

The US dollar dipped late last week after the US Supreme Court ruled tariffs proposed by President Trump unconstitutional, and quarterly US GDP data showed a sharper-than-expected slowdown in late-2025. Markets will watch a speech by Fed policymaker Christopher Waller today for fresh impetus; a hawkish tone could help the dollar start the week on the front foot. In the near term, the dollar remains vulnerable to Fed expectations and shifts in risk sentiment. In the medium term, dedollarization trends and geopolitics keep a lid on sustained USD strength unless US growth outpaces peers.

Key drivers

- Federal Reserve's Monetary Policy: The rate path remains a primary driver. Higher rates attract capital and tend to support the dollar, so any signal from Waller or upcoming data that the Fed stays hawkish could bolster the USD.

- Global Trade Dynamics: The US current account situation and trade balance influence dollar demand. A persistent deficit can dampen the dollar, while signs of narrowing trade gaps could help stabilize it.

- Geopolitical Events: Safe-haven buying tends to lift the USD during international tensions or risk-off episodes, though lasting gains depend on the broader macro backdrop.

- Dedollarization Trends: Longer-term moves away from the dollar by some countries in trade and reserves can temper broader USD demand over time.

Range

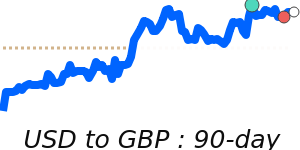

USD/EUR sits at 0.8453, about 0.8% below its 3-month average of 0.8518, having traded within a 0.8312–0.8679 band (4.4% range). USD/GBP is at 0.7391, near its 3-month average, with a 0.7227–0.7629 range (5.6%). USD/JPY posts 154.3, around 1.1% below its 3-month average of 156, moving in a 152.3–159.1 range (4.5%). Oil, priced in USD (Brent Crude OIL/USD), is 70.88, about 10.0% above its 3-month average of 64.43, within a very volatile 59.04–71.76 range (21.5% volatility). Oil moves can influence EUR dynamics through energy costs and trade flows.

What could change it

- Hawkish Fed tilt: A firmer tone from Waller or stronger-than-expected US data could push the USD higher on a higher-for-longer rate path.

- U.S. macro data surprises: Hotter inflation or stronger growth would lift rate expectations; softer data could weigh on the dollar.

- Global risk sentiment: Escalating geopolitical tensions or risk-off surroundings can boost the USD; a calmer environment could ease USD strength.

- Oil price direction: Further upside or downside in crude can affect USD-linked currencies via commodity channels and trade balances.

- Dedollarization developments: Any acceleration in alternative currencies’ use for trade and reserves could temper long-run USD demand.