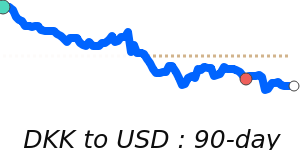

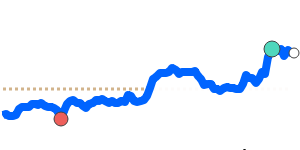

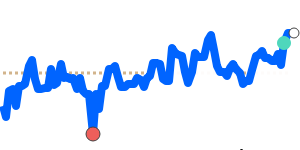

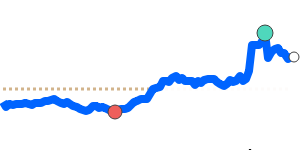

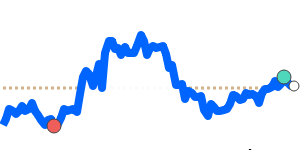

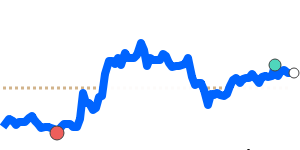

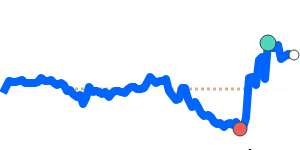

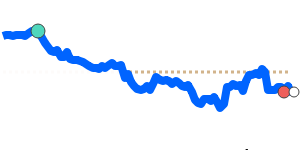

USD/DKK Outlook:

The USD/DKK exchange rate is currently near its recent average and trading at 30-day highs. This suggests a range-bound outlook with the potential for slight upward movement as market conditions stabilize.

Key drivers:

• Rate gap: The Federal Reserve's interest rate policies are maintaining a stronger USD compared to Denmark's stable monetary stance.

• Risk/commodities: Elevated interest in safe-haven assets due to ongoing geopolitical tensions supports the USD's strength, while broader oil price dynamics create volatility.

• Macro factor: Strong US economic data, including higher producer price inflation, may reinforce USD appreciation in the near term.

Range:

Expect USD/DKK to hold within its established 3-month range of approximately 6.2069 to 6.4486 as it navigates current market signals.

What could change it:

• Upside risk: A robust reading from upcoming US manufacturing PMI could buoy the USD further.

• Downside risk: Any significant deterioration in US economic outlook could lead to a depreciation of the USD against the DKK.