The British pound (GBP) has shown signs of recovery, trending higher at the start of the week following Prime Minister Kier Starmer’s endorsement of Chancellor Rachel Reeves. This support has provided some reassurance to investors, allowing the currency to bounce back from a recent sell-off. However, the gains remain modest as concerns about fiscal deficit risks loom, particularly following the government's welfare reform adjustments.

Data releases from the UK have been limited, suggesting that GBP movements may largely reflect broader market trends rather than specific domestic signals. It’s notable that the pound is facing downward pressure from external factors, including the recent implementation of a 10% reciprocal tariff on UK goods by the United States, which could disrupt trade and economic growth.

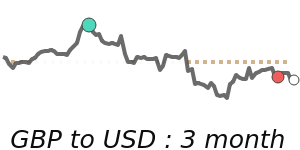

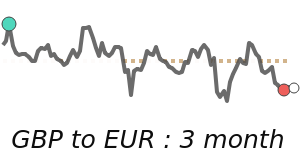

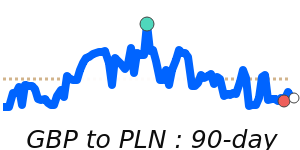

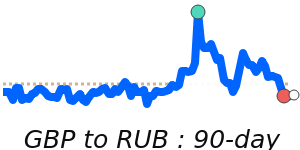

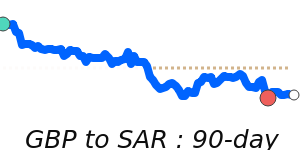

In recent trading, the GBP/USD pair is hovering near 14-day lows at approximately 1.3427, which is aligned with its three-month average. This pair has recently traded within a stable range of 4.3%, indicating limited volatility. Conversely, against the Euro, the GBP has reached 90-day lows at around 1.1510, about 2.0% below its three-month average, signifying potential eurozone influences that have affected sterling’s value.

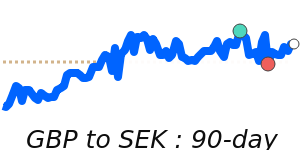

On a more positive note, the GBP/JPY exchange rate is currently at 198.4, which is 2.0% above its three-month average of 194.5. This pair has demonstrated a stable trading range of 6.0%, suggesting that there is some resilience in GBP against the yen, despite broader uncertainties.

Looking forward, the future trajectory of the pound will hinge on the UK’s economic recovery, potential changes in monetary policy by the Bank of England, and ongoing developments in trade negotiations. Investor confidence remains a crucial driver, especially in a post-Brexit landscape where political and economic stability will significantly impact exchange rates. As such, monitoring economic indicators and political events will be essential for those affected by fluctuations in the currency market.