Outlook

The pound faces renewed downside pressure as BoE rate-cut bets rise after UK unemployment moved to a five-year high and wage growth slowed. Markets expect a March easing if inflation continues to cool, making the upcoming UK CPI data a key catalyst. A cooler CPI could accelerate BoE easing and weigh on GBP, while a firmer inflation print could delay cuts and offer some relief. The Fed’s policy stance remains a major driver: a broader path of easing in the US tends to weaken the pound, whereas a shift that narrows the policy gap could provide modest support. Global risk sentiment continues to add volatility to the mix.

Key drivers

- Bank of England monetary policy: cautious stance, holding rates at 4% amid inflation and wage pressures; softer UK data reinforces expectations of March easing.

- U.S. Federal Reserve policy divergence: markets monitor how the Fed’s pace of cuts compares with the BoE, influencing GBP strength vs USD.

- Global economic uncertainties: geopolitical tensions and risk sentiment drive safe-haven flows and GBP volatility.

- Inflationary pressures: UK CPI and wage data remain central to BoE timing; softer inflation reinforces easing bets.

Range

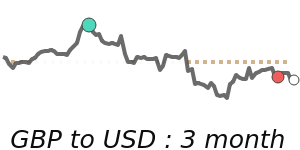

GBP/USD is trading around 1.3495 on 14-day lows, just above its 3-month average, within a 1.3070–1.3837 range (about 5.9%).

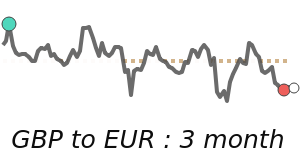

GBP/EUR is around 1.1443 on 30-day lows, just below its 3-month average, within a 1.1339–1.1590 range (about 2.2%).

GBP/JPY is at 208.8, about 0.6% below its 3-month average of 210, within a 204.9–214.3 range (about 4.6%).

What could change it

- hotter-than-forecast UK CPI or wage data, delaying BoE easing and supporting GBP

- a shift in US policy where the Fed moves more aggressively on cuts or signals a longer path of easing, weighing on GBP

- a shift in global risk appetite that alters demand for USD versus the pound