The British pound (GBP) began the week under pressure, despite positive GDP data revealing that the UK was the fastest-growing economy in the G7 during the first quarter. This optimism was tempered by concerns over falling real household disposable income per head, marking its first quarterly decline in nearly two years. Analysts note that this decline could undermine consumer confidence, potentially impacting economic recovery.

Additionally, GBP investors are keenly awaiting comments from Bank of England (BoE) Governor Andrew Bailey at the European Central Bank's annual Sintra forum, with any insights into future monetary policy likely to influence market sentiment further.

Recent geopolitical developments have also impacted sterling's value. The imposition of a 10% tariff by the US on UK goods, linked to ongoing trade tensions, could threaten trade flows and further complicate the UK’s post-Brexit position in international markets.

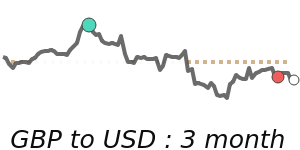

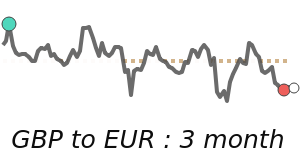

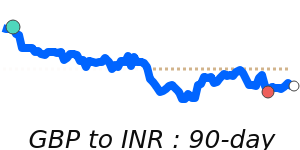

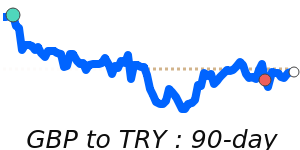

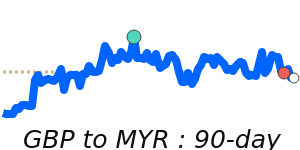

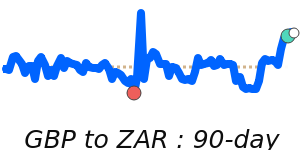

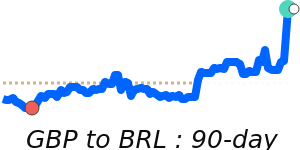

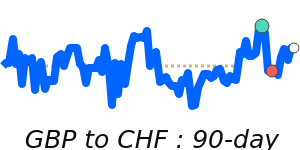

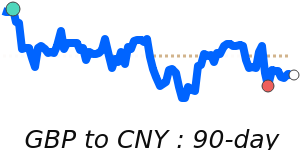

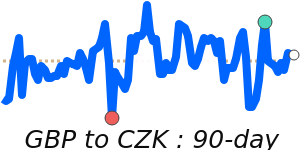

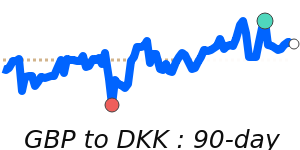

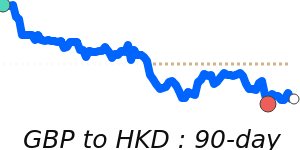

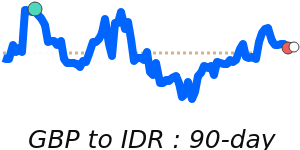

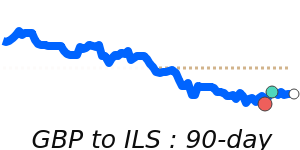

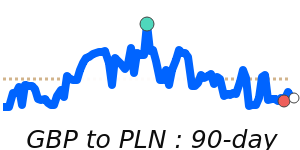

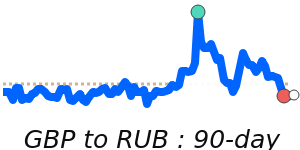

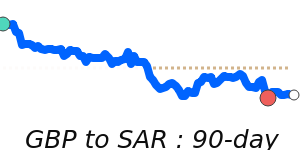

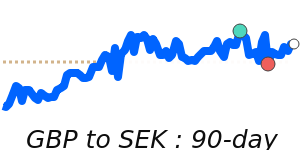

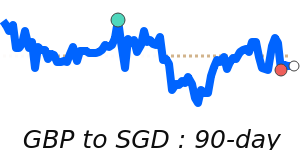

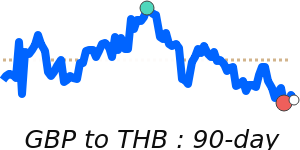

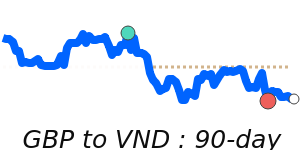

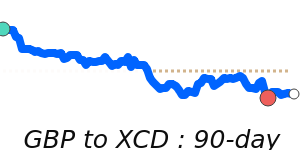

In the context of currency pairs, the GBP/USD is currently trading at 90-day highs of approximately 1.3735, significantly above its three-month average of 1.3363, and within a stable range. In contrast, the GBP/EUR is facing challenges, reaching 60-day lows around 1.1650, reflecting a slight decline from its three-month average of 1.1770. The GBP/JPY pair, meanwhile, is performing robustly, at 197.4, exceeding its average, indicating some strength against the Japanese yen.

Experts emphasize that movements in the GBP are heavily influenced by domestic economic indicators and political stability, alongside international market sentiment. Given the ongoing economic transformation and the potential effects of the BoE's monetary policies, the outlook for the pound remains dynamic, with eyes on further economic data and geopolitical developments that may sway its trajectory in the near term.