The Polish zloty (PLN) has been under pressure recently, experiencing a decline of nearly 3% against the euro following the National Bank of Poland’s (NBP) unexpected interest rate cut in September. Central bank governor Adam Glapiński emphasized that this decision stemmed from a "radically changed" economic outlook, particularly highlighting concerns about a potential recession in Germany. As Germany faces stagflation with rapidly deteriorating industrial production, the close economic ties between Poland and Germany pose significant risks for Polish exports and, by extension, the PLN.

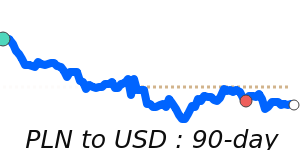

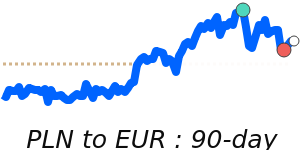

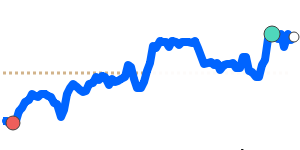

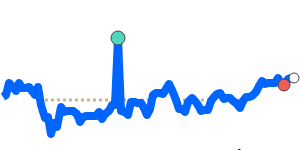

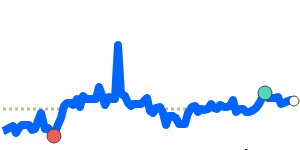

Recent market data shows that the PLN to USD is currently at 0.2775, which is 3.9% higher than its three-month average of 0.2671. This pair has shown volatility, trading within an 11.1% range from 0.2542 to 0.2823. The PLN to EUR is slightly above its three-month average at 0.2358, having fluctuated within a more stable range of 6.7%, from 0.2328 to 0.2483.

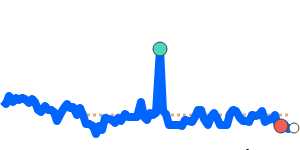

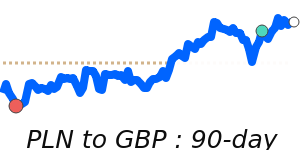

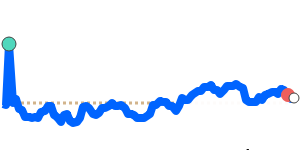

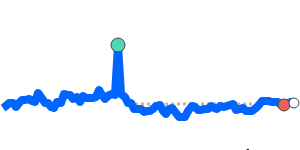

In contrast, the PLN to GBP is trading at 60-day highs near 0.2030, marking a 1.7% increase over the three-month average of 0.1996, within a comparatively stable range of 0.1965 to 0.2121. Additionally, the PLN to JPY is also at recent highs around 40.16, reflecting a 4.1% increase above its three-month average of 38.57, despite having experienced an 8.9% range from 37.22 to 40.54.

Economic analysts note that the ongoing conflict in Ukraine continues to exert influence over the Polish economy and the zloty, complicating the outlook. As the situation develops, keeping an eye on key economic indicators in both Poland and its largest trading partner, Germany, will be crucial for those engaged in international transactions involving the PLN.