Swiss Franc Surges Amid U.S. Tariff Escalation - 2025-04-11

The Swiss franc has experienced a significant surge, reaching a decade-high against the U.S. dollar, following President Donald Trump's announcement of increased tariffs on Chinese imports. This development has intensified market volatility and heightened demand for safe-haven assets.

Yuan's Volatility Surges Amid U.S. Tariff Escalation - 2025-04-10

The Chinese yuan has weakened following the United States' decision to impose a 125% tariff on Chinese imports, prompting the People's Bank of China to intervene to stabilize the currency.

Mexican Peso Faces Uncertainty Amid U.S. Tariff Threats and Economic Policies - 2025-04-08

The Mexican peso's outlook for 2025 is clouded by potential U.S. tariffs and economic policies, with forecasts indicating possible depreciation against the U.S. dollar.

Global Currency Markets React to U.S. Tariffs and Economic Policies - 2025-03-27

Recent U.S. trade policies, including aggressive tariffs on auto imports, have introduced significant volatility in global currency markets, affecting major currencies such as the euro, British pound, and Japanese yen.

Indonesian Rupiah Nears Record Low Amid Fiscal Concerns - 2025-03-26

The Indonesian rupiah approaches a historic low against the U.S. dollar, influenced by fiscal worries and government spending plans.

Currency Markets in Flux: Euro's Ascent Amidst Global Economic Shifts - 2025-03-19

The global currency landscape is experiencing notable shifts as the euro strengthens against major currencies, influenced by economic policies, geopolitical events, and fluctuating oil prices.

How the Weak US Dollar Can Impact International Business in 2025

Markets have shifted focus to the interest rate policies of other major central banks rather than the Federal Reserve.

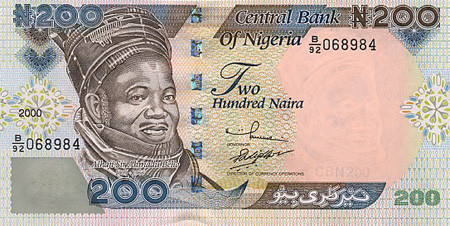

Nigeria's Decision to End Currency Peg Triggers Historic Naira Plunge - 2023-06-20

Central Bank Chief's Removal Sets Stage for Currency Liberalization

Banks Charge Small Customers 25 Times More for FX, Research Shows

New research from the European Central Bank shows that banks charge smaller customers up to 25 times more for FX forward transactions and that those who fail to compare providers pay 14 times more for FX than those that do.