Are Wise Exchange Rates Guaranteed?

Yes, for a fixed time.

After creating your money transfer order, Wise will lock in the displayed exchange rate for a 24 or 48-hour period, depending on the currencies in question. As long as Wise receives your funds within that window, it guarantees that the receiving account gets exactly what was shown at the time you created the transfer order. In all cases, you will be told for how long your guarantee is in place at the time you create the order—this will be shown next to the exchange rate.

Should you fail to provide funds quickly enough, Wise will amend your transfer order to reflect the new mid-market exchange rate, which might be to your benefit or detriment.

As for weekends, when most banks don't process transfers, these are ignored. For example, if you create a EUR to GBP transfer (a 48-hour rate guarantee) at 5pm on a Friday, Wise will guarantee the exchange rate so long as funds are received before the same time on Tuesday.

The exception to the above comes with GBP payments. Because most banks in the UK do process transfers on the weekend, Wise will include weekend days. For example, a GBP to EUR transfer (a 24-hour rate guarantee) created on Friday at 5pm will be guaranteed until 5pm on Saturday.

How Long Will My Transfer Take?

After Wise receives your funds, these will usually arrive at the destination bank account within two business days (many transfers will be same-day), although it can take longer depending on the currencies involved (additional security checks may be required), on the time of day you make your transfer and on the timing of national holidays.

Before you confirm any order, Wise gives you a chance to review it, and this review includes the “should arrive by” date.

Is Wise Safe?

Readers will be pleased to learn that Wise is a highly regulated firm. As of 2019, it is regulated by financial authorities in the US, UK, EEA, Singapore, New Zealand, Japan, Australia, Hong Kong and Canada.

Importantly, in order to meet the requirements of regulators, Wise must separate your money from theirs, which means that in the highly unlikely event that Wise goes to pot, your money will be returned.

Wise deploys a number of measures aimed at protecting your account; these include a 2-step login and Transport Layer Security encryption to protect transactions and all communications with the company. Wise also monitors accounts and customer profiles for unusual activity.

How Can I Send and Receive Funds?

For the majority of currencies, you will need to send funds to Wise from a bank account. For some currencies, you will be offered alternative funding methods including debit and credit cards (Visa, Mastercard and Maestro), Apple Pay or Android Pay, and if you are in one of the participating European countries, SOFORT. Be aware that alternative funding methods may incur additional charges.

A Wise limitation is that funds must be paid into a bank account.

Transfer Limits

Transfer limits will only affect a small minority of Wise customers (the send/receive limit for euro transfers, for example, is €1.2 million). In all cases, Wise will tell you when you’ve exceeded its limits via an error message at the time you create your transfer order.

Transfer limits are unique to each currency, so for further information either contact Wise or search within the company’s online Help Centre. Be sure to check limits for both currencies since Wise will apply the lowest of these.

###Daily fee for holding large amounts

Wise charge a daily fee for holding large amounts in your currency accounts, the maximum free amounts and fees that are then charged depend on the currency.

For excample you can hold up to the following amounts for free:

If you go over your free allowance for more than 3 days, Wise will start charging the annual fee of 1.6%. This is equivalent to approximately 0.00437% daily.

Customer Service

Wise offers email support and 13 national phone lines for support in your language.

Be aware that Wise phone support is not available 24/5. Each of the local phone lines will be available on business days only and for its own unique hours; these are displayed after you select your region on Wise's ‘Contact Us’ page.

A slight knock on the Customer Service front is that Wise’s Live Chat feature seems to be continually unavailable.

BER research indicates that roughly 75 percent of Wise users who had cause to contact customer service were happy with their experience, which is in line with the industry average. Roughly a quarter of those with issues claim that customer service was unsupportive or that emails weren’t replied to.

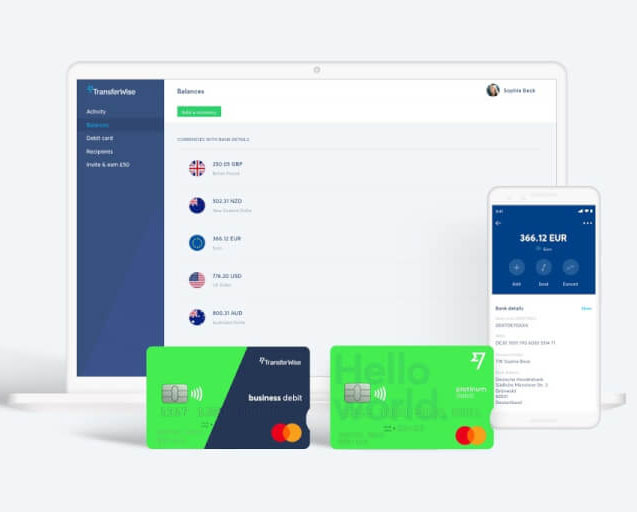

Wise Multi-Currency Accounts

Another impressive service offered by Wise is their Wise Multi-Currency Accounts. These allows users to hold and convert funds in 40 different currencies, and make and receive payments in those currencies with the same excellent exchange rates (the real, mid-market rates) and low fee structure that comes with Wise’s basic money transfer service. The account costs nothing and there is no minimum balance.

Domestic & International - Share these for someone to pay you in the same currency by local bank transfer.

International Only - Share these for someone to pay you any currency Wise supports by SWIFT transfer.

- United Arab Emirates dirham

For a more in-depth look you can read our BER Review - Wise Account.

###Wise Debit Card

A market leading multi-currency debit Mastercard with Zero foreign transaction fees plus no annual fees and low currency conversion fees.

The Wise account and debit card are free to set up and use. And there's never any monthly fee and minimum balance to worry about.

Free ATM withdrawals worldwide up to $350 every 30 days then a 2% charge on additional withdrawals.

Auto-convert any currency - Spend in any currency and the Wise smart tech will auto-convert it with the lowest possible fee.

Unlike practically all other Travel cards you can pay foreign currency into this card via your own personal foreign currency bank accounts.

Using your Wise card to send money.

These transactions cost more money to process than others and are treated like a cash advance. So, Wise charge a fee of 2% of the transaction amount on certain currencies when you use your Wise card to send money to e-wallets or other accounts which can be converted to cash (including, but not limited to, casino chips, cryptocurrencies and lottery tickets).

###What Do Users Think of Wise?

As of September 2024, user reviews are overwhelmingly positive.

On one popular review site, more than 85 percent of the 57,000 Wise users gave the company a 5-star rating; only 3 percent said they had a “bad” experience.

Recurring themes within reviews relate to “fantastic service,” “awesome rates,” “super fast” and “easy transfers.”

Positive

- One of the cheapest services around

- Fast sign-up and verification

- Broad coverage

- Plenty of customer service options

- Highly rated by customers

Negative

- Transfers to bank accounts only

- No dealers to discuss orders with

- Fees to leave larger balances in Wise

Wise (TransferWise) takes a machete to the hefty fees that banks levy to send money across borders. — The Economist.

The Wise SGD to USD exchange rate is 0.7781. This is -0.6% compared to the latest SGD-USD mid-market rate 0.7828.

As exchange rates can vary

significantly between banks and also between currency exchange providers,

it's therefore important to carefully compare

Singapore dollar (SGD) to US dollar (USD) rates from different sources before making a conversion.

It's important to note that exchange rates also fluctuate frequently due to market conditions. Additionally,

banks and foreign exchange providers often apply a margin to the exchange rate, resulting in a less favorable rate for customers compared to the mid-market rate.

For more competitive rates, you might consider using a specialized currency exchange service

like Wise or platforms that offer rates closer to the mid-market rate.