The US dollar (USD) is currently experiencing strength, benefitting from safe-haven flows and a recent reduction in expectations for Federal Reserve interest rate cuts. Analysts attribute part of this rise to encouraging remarks from the Trump administration, implying that multiple trade deals will be announced ahead of the upcoming tariff deadline on July 9. However, if the announced trade agreements do not meet market expectations, there may be potential headwinds for the dollar in today’s trading sessions.

The USD remains the world’s most traded currency and a key benchmark influenced by a variety of factors. Current Federal Reserve interest rate policies heavily dictate its strength; as higher rates typically attract investors, increasing demand for the dollar. Conversely, lower rates or a dovish stance could weaken its value. Economic indicators such as inflation, employment data, and GDP growth will play crucial roles in determining USD’s movement in the coming weeks.

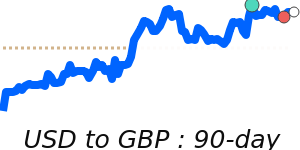

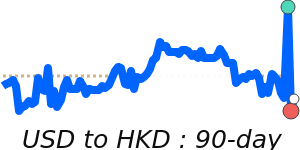

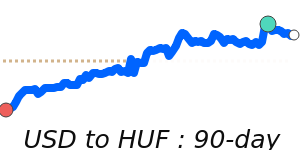

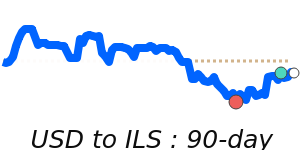

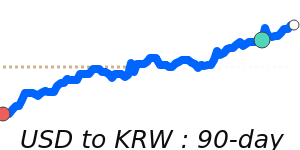

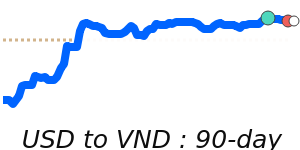

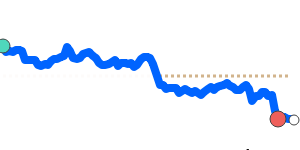

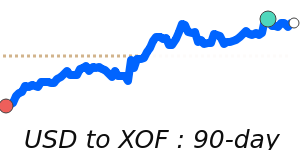

Recent data indicates significant fluctuations in key USD pairs. The USD to EUR is currently at 0.8530, approximately 2.6% below its three-month average of 0.8755, showing stability within a 7.8% range between 0.8470 and 0.9131. Meanwhile, the USD to GBP is trading near 0.7361, which represents a 14-day high, yet is still 1.2% below its three-month average of 0.745, indicating a stable trading corridor between 0.7275 and 0.7795. On the other hand, the USD to JPY is at 146.9, marking a 30-day high that is 1.7% above its three-month average of 144.4, trading within a narrow 5.4% range of 140.9 to 148.5.

In the commodities market, oil prices are influencing the USD as well, currently trading at 70.15, which is 4.8% above its three-month average of 66.91. The oil market has exhibited notable volatility with a staggering 31.1% range between 60.14 and 78.85, likely impacting the dollar's demand as oil remains a key commodity priced in USD.

Experts suggest that the outlook for the dollar will continue to hinge on Federal Reserve policies, inflation dynamics, economic performance, and geopolitical developments. While concerns around de-dollarization persist, the USD firmly retains its role as a backbone of the global economy, affecting markets worldwide. As such, businesses and individuals engaged in international transactions should remain vigilant to these influences to optimize their strategies.