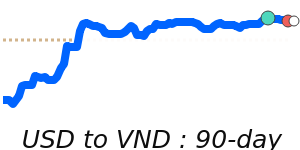

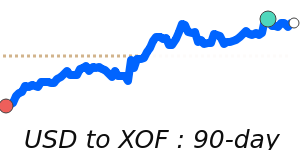

The US dollar (USD) has shown notable strength lately, primarily fueled by safe-haven flows and a recalibration of Federal Reserve interest rate cut expectations. Analysts have noted that recent comments from the Trump administration regarding potential trade deals ahead of the tariff deadline on July 9 may contribute further to the dollar's appreciation.

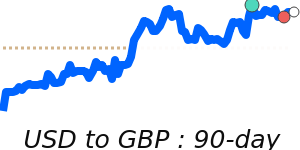

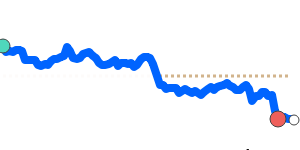

In currency pair movements, the USD reached 14-day highs against the Euro (EUR), now priced at approximately 0.8572, which is 1.9% below its three-month average of 0.8734. Despite this, trading has remained stable within a 6.5% range. Conversely, the USD to British pound (GBP) exchange rate stands near 0.7448, reflecting close alignment with its three-month average while maintaining a steady range. More significantly, the USD to Japanese yen (JPY) is currently at about 147.8, which marks a 60-day high—2.2% above its three-month average of 144.6, supporting the notion that the dollar benefits in times of economic uncertainty.

Economic indicators such as U.S. inflation, employment data, and GDP growth will continue to be pivotal in shaping the dollar’s trajectory. Analysts assert that the Federal Reserve's monetary policy remains crucial; higher interest rates typically allure investors, strengthening the dollar, while a dovish approach may dampen its appeal.

In commodity markets, the oil price, now at 69.21 USD, is 2.9% above its three-month average. With oil being a key commodity priced in dollars, fluctuations in oil prices can significantly impact the demand for the dollar, inherently linking the strength of the currency to global economic sentiments.

Given these dynamics, any disappointment in upcoming trade deals could present headwinds for the dollar. However, the prevailing geopolitical tensions and sustained demand for the safe-haven appeal of USD may continue to support its value in the near term. Investors are advised to keep an eye on Federal Reserve communications, as shifts in policy or rate expectations can result in notable trading volatility.