Receiving an international wire transfer at Chase Bank

Chase Bank has several bank codes that may be used for receiving foreign wire transfers, depending on the currency and location of the sending bank. Here are some of the most common codes used for Chase Bank:

SWIFT Code: CHASUS33: This code is used for receiving wire transfers in U.S. dollars from foreign banks.

CHIPS UID: 0002: This code is used for receiving wire transfers in U.S. dollars from foreign banks that are members of the Clearing House Interbank Payments System (CHIPS).

Fedwire ABA Routing Number: 021000021: This code is used for receiving wire transfers in U.S. dollars from banks located within the United States.

ABA Routing Number for Wire Transfers: 021000021: This code is used for receiving wire transfers in U.S. dollars from banks located outside of the United States.

It's important to note that specific codes may vary depending on the currency and location of the sending bank, and it's recommended to confirm the correct codes with Chase Bank before initiating a wire transfer.

Chase credit card FX fees

Chase Bank offers several credit cards with different foreign transaction fees. Here are some examples:

Chase Sapphire Preferred Card: This card charges no foreign transaction fees, making it a good option for travelers who frequently make purchases in foreign currencies.

Chase Sapphire Reserve: Similar to the Sapphire Preferred Card, this card also does not charge foreign transaction fees.

Chase Freedom Unlimited: This card charges a foreign transaction fee of 3% of each transaction in U.S. dollars.

Chase Freedom Flex: Similar to the Freedom Unlimited, this card also charges a foreign transaction fee of 3% of each transaction in U.S. dollars.

United Explorer Card: This card charges a foreign transaction fee of 0% to 3% of each transaction in U.S. dollars, depending on the currency used.

It's important to note that credit card terms and conditions can change, so it's always a good idea to check the current fees and policies before applying for or using a credit card for foreign transactions.

If you wish to save on exchange rates and foreign ATM fees then you should consider the  Wise multi-currency card.

Wise multi-currency card.

Everyday Costs in in Falkland Islands

How much does it really cost to live, work, or travel in ? Here's what to expect for daily expenses and expat living.

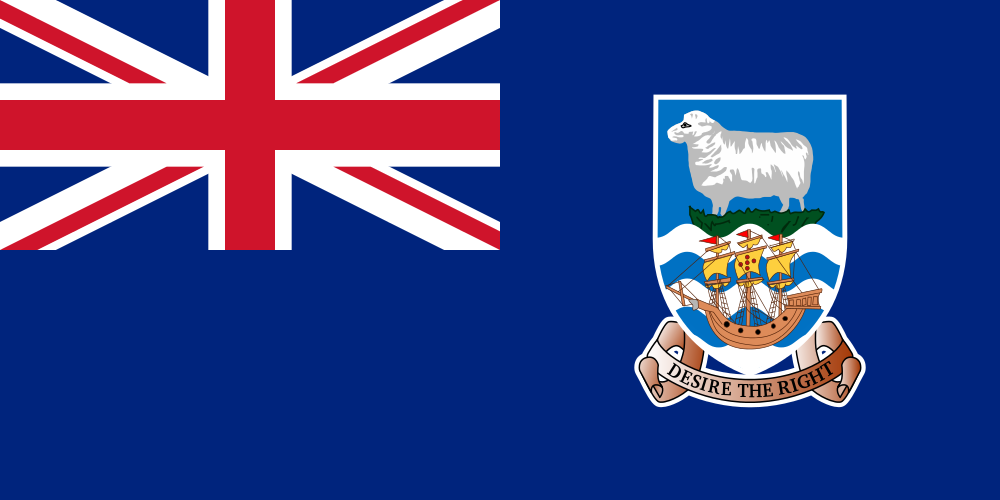

Traveling to the Falkland Islands (ISO Code: FK)

For those planning a week-long mid-range stay in the picturesque Falkland Islands, budgeting effectively is crucial. Travelers can expect to spend approximately £800 to £1,000 for a comfortable week, covering accommodation, meals, and activities. Here’s a breakdown of typical daily expenses in British pounds (£):

- 🍽️ Meal at a local restaurant: £15-£20

- 🚍 Public transport fare: £2-£3

- 📱 Prepaid SIM card: £10-£20

- 🏨 Budget hotel or Airbnb: £50-£80 per night

Overall, the Falkland Islands tend to be considered an average to slightly expensive destination, especially when compared to the United States—where similar mid-range options can be more affordable. For instance, a week in the UK can be comparable in costs, while the Falklands might be pricier than major destinations in Australia due to limited local services and imported goods impacting daily prices.

Living as an Expat in the Falkland Islands

For expats making the Falkland Islands their new home, typical monthly living costs can range from £1,500 to £2,500, depending on one’s lifestyle choices. Key expenses may include rent, utilities, and food. It's advisable to explore banking options with local banks, especially if you expect to handle cash transactions frequently. In terms of card usage, credit and debit cards are widely accepted, although it's prudent to have some cash on hand for smaller vendors. When sending or receiving international money, services like Wise or OFX are generally recommended for their competitive exchange rates and lower fees compared to traditional banks. However, always check the local currency exchange rates; sometimes, exchanging a small amount of cash locally can save on immediate needs due to minimal transaction fees.