Learn more about PNC Wires

Besides the FX rate markup shown in the comparison table, PNC Bank may also charge additional fixed fees for wire transfers depending on several factors, such as the type of transfer, the destination country, and the currency being sent. Here are some general guidelines for wire transfer fees with PNC Bank:

- Domestic incoming wire transfers: $15 per transaction

- Domestic outgoing wire transfers: $30 per transaction

- International incoming wire transfers: $15 per transaction

- International outgoing wire transfers: $45-$50 per transaction, depending on the destination country and currency

Note that these are the standard fees, and additional fees may apply depending on the specific circumstances of the wire transfer. For example, intermediary banks involved in the transfer may charge their own fees, which can be passed on to the customer.

Receiving an international wire transfer at PNC Bank

PNC Bank uses different bank codes depending on the currency and location of the sending bank. Here are some of the most common bank codes used for receiving foreign wire transfers:

SWIFT Code: PNCCUS33: This code is used for receiving wire transfers in U.S. dollars from foreign banks.

ABA Routing Number: 043000096: This code is used for receiving wire transfers in U.S. dollars from banks located within the United States.

CHIPS UID: 0407: This code is used for receiving wire transfers in U.S. dollars from foreign banks that are members of the Clearing House Interbank Payments System (CHIPS).

Fedwire ABA Routing Number: 043000096: This code is used for receiving wire transfers in U.S. dollars from banks located outside of the United States.

It's important to note that specific bank codes may vary depending on the currency and location of the sending bank, and it's recommended to confirm the correct codes with PNC Bank before initiating a wire transfer.

PNC Bank credit card FX fees

PNC Premier Traveler Visa Signature Credit Card: This card charges no foreign transaction fees, making it a good option for travelers who frequently make purchases in foreign currencies.

PNC Points Visa Credit Card: Similar to the Premier Traveler Visa Signature Credit Card, this card also does not charge foreign transaction fees.

PNC Cash Rewards Visa Credit Card: This card charges a foreign transaction fee of 3% of each transaction in U.S. dollars.

PNC Core Visa Credit Card: Similar to the Cash Rewards Visa Credit Card, this card also charges a foreign transaction fee of 3% of each transaction in U.S. dollars.

It's important to note that credit card terms and conditions can change, so it's always a good idea to check the current fees and policies before applying for or using a credit card for foreign transactions.

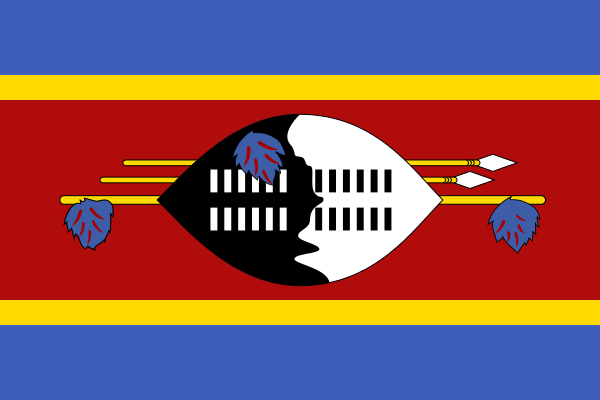

Everyday Costs in in Swaziland

How much does it really cost to live, work, or travel in ? Here's what to expect for daily expenses and expat living.

Currency Guide for Eswatini (ISO Code: SZ)

For travelers planning a week-long mid-range stay in Eswatini, budgeting approximately E7,000 (about $400 USD) should suffice. This amount can comfortably cover daily expenses, allowing for both local experiences and relaxation. Typical daily costs are as follows: 🍽️ E100 for a meal at a local restaurant, ☕ E30 for a coffee, 🚌 E20 for public transport fare, 📱 E300 for a prepaid SIM card, and 🏨 E500 for a budget hotel or Airbnb. Eswatini is generally considered an affordable destination compared to the United States, where similar expenses can be significantly higher. For instance, you might pay E100 for a meal in Eswatini, while in the US, the same meal can range from $15 to $25. Comparatively, visiting the UK can be quite pricey, with higher daily costs across similar categories, making Eswatini a more budget-friendly option.

For expats relocating to Eswatini, the typical monthly living costs are around E15,000 (approximately $850 USD), which includes rent, groceries, utilities, and transportation. Banks in Eswatini generally offer decent services, but it's advisable to carry a local currency for everyday transactions, as many local businesses may not accept cards. Most expats find that using local ATMs is the most efficient way to withdraw cash, although it's crucial to check your bank's fees for international usage. When it comes to international transfers, online services like Wise and OFX often provide better exchange rates and lower fees compared to traditional banks. If you're moving funds frequently, consider exchanging money locally, as this can sometimes yield a more favorable rate than transferring, especially for smaller amounts.