CAD Market Update

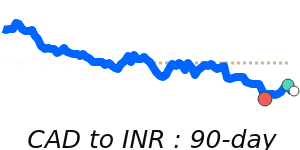

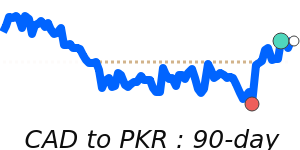

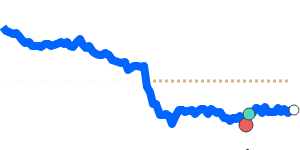

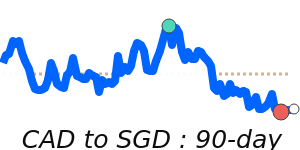

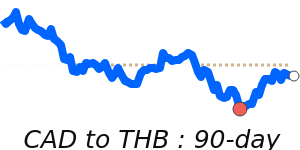

The Canadian dollar has seen some mixed movements recently, influenced primarily by oil prices and geopolitical tensions. After climbing earlier this week, oil prices eased slightly, which put pressure on the CAD. However, with oil still elevated due to supply concerns stemming from the Middle East, the CAD remains supported on the fundamentals.

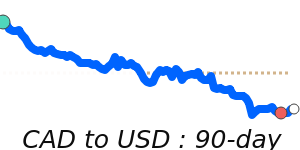

against the US dollar, the CAD is trading near its 14-day high around 0.7365, roughly 1.1% above its three-month average. While the USD has gained strength amid safe-haven flows from recent geopolitical fears, the Canadian dollar's oil sensitivity could help it stabilize if crude prices stay firm.

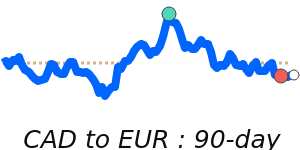

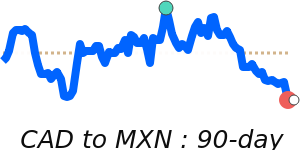

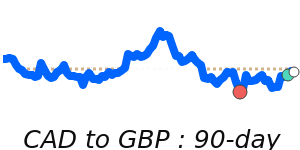

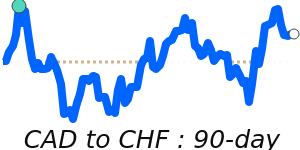

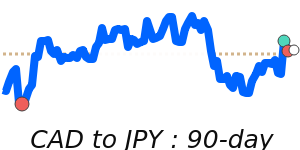

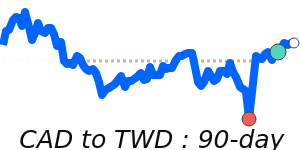

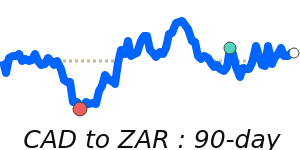

In relation to the Euro and British pound, the CAD is also trading higher—around 0.6337 and 0.5499 respectively—boosted by Canada's energy exports. The currency remains close to 90-day highs with the JPY and CHF, reflecting its risk-linked strength against those safe-haven currencies.

Overall, while the USD retains an initial edge from risk-off sentiment, ongoing oil support suggests the CAD could hold or extend recent gains, especially if oil prices stay elevated. Traders should keep an eye on crude markets, as they are key to Canada's near-term currency outlook.