Outlook

Outlook: In the near term, USD/CAD could rise as the USD benefits from safe-haven demand amid tensions. If oil remains elevated, CAD should stabilise and may outperform other commodity-linked currencies when energy prices stay high. A stable oil backdrop could keep CAD well bid versus EUR and GBP.

Key drivers

Key drivers

- Oil price strength supports CAD because Canada is a major oil exporter.

- Safe-haven USD demand weighs on CAD early in macro shocks.

- CAD remains sensitive to U.S. policy and trade developments.

Range

Range

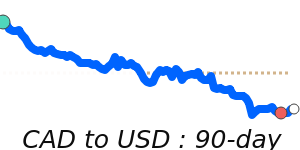

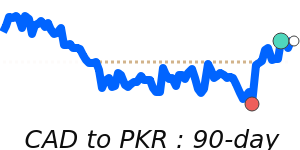

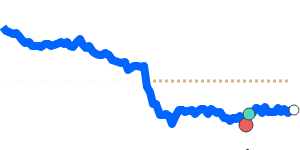

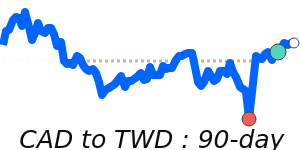

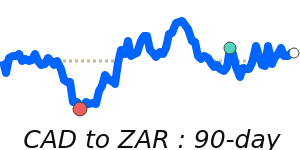

CAD/USD: 0.7314, just above its 3‑month average, within a tight range of 0.7154–0.7413.

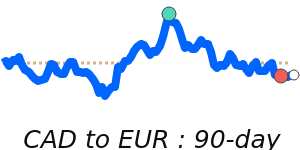

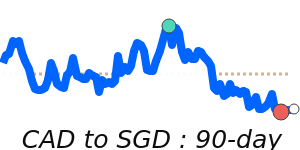

CAD/EUR: 0.6256 near 90-day highs, about 1% above its 3‑month average of 0.6193, within 0.6120–0.6256.

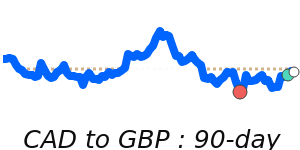

CAD/GBP: 0.5458 near 90-day highs, about 1.1% above its 3‑month average of 0.5396, within 0.5322–0.5458.

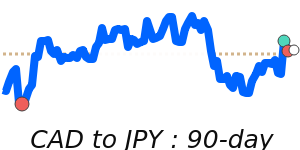

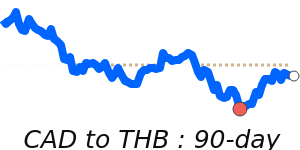

CAD/JPY: 115.0, 1.2% above its 3‑month average of 113.6, within 111.1–115.3.

Oil: 77.99, near 90-day highs, about 19.3% above its 3-month average of 65.39, within 59.04–77.99.

What could change it

What could change it

- Oil moves lower, weakening the energy wind for CAD.

- A clear shift in U.S. policy or trade terms changes CAD dynamics.