Outlook

Outlook: The yen faces supportive signals from BOJ normalization but remains exposed to external balance pressures and fiscal risks. The December 2025 rate hike to 0.75% and the move away from negative rates point to a higher-for-longer stance, with a current policy rate around 0.5%—the highest in over a decade. With inflation around 3% in November and ongoing fiscal concerns ahead of elections, yen gains could be tempered by debt sustainability worries. A run-up in global oil prices has kept import costs elevated, adding another drag on the currency when risk appetite softens. In practice, the JPY may continue trading in narrow ranges versus USD, EUR, and GBP unless key global drivers shift, notably US rate paths, oil prices, or Japanese fiscal policy clarity.

Key drivers

Key drivers:

- BOJ policy normalization continues, ending negative rates and moving toward a higher-for-longer trajectory (policy rate around 0.5% after December 2025, with a 0.75% peak previously).

- Inflation near 3% in November keeps pressure on the BOJ to maintain cautious policy with potential further adjustments.

- Fiscal concerns and political risks in Japan as tax-cut proposals emerge ahead of elections, raising deficits and debt sustainability worries.

- Global oil price surge increasing Japan’s import costs and acting as a headwind for the yen.

- Markets have largely priced in the normalization path, but shifts in oil, US yields, or risk sentiment could alter the currency’s direction.

Range

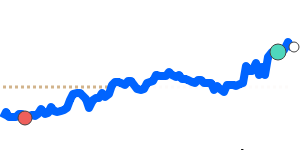

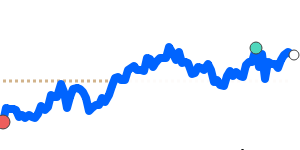

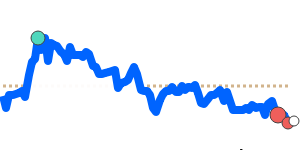

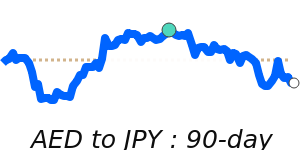

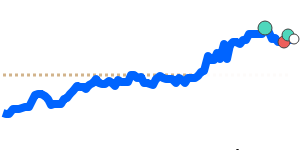

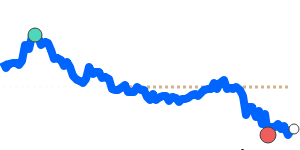

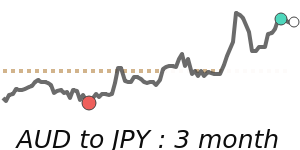

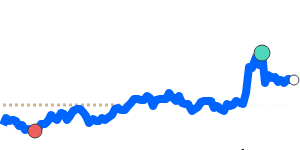

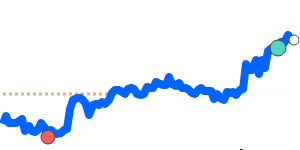

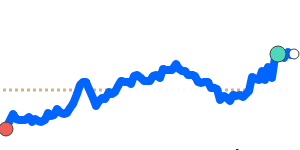

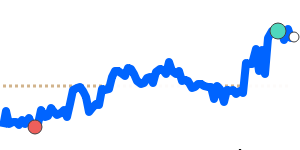

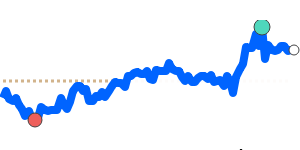

Range: JPY to USD is at 7-day lows near 0.006445, just 0.6% above its 3-month average of 0.006409, having traded in a stable 4.5% range from 0.006284 to 0.006566. JPY to EUR is at 7-day lows near 0.005476, just above its 3-month average, in a very stable 3.4% range from 0.005370 to 0.005552. JPY to GBP is at 0.004789, just 0.6% above its 3-month average of 0.004762, trading in a stable 4.6% range from 0.004666 to 0.004881.

What could change it

What could change it:

- A surprise shift in BOJ policy or inflation data that alters the expected normalization path.

- Significant moves in global oil prices that change Japan’s import costs and trade balance.

- Developments in Japan’s fiscal policy or debt dynamics that affect investor confidence.

- Shifts in US yields, dollar strength, or global risk sentiment that drive risk appetite and carry trade flows.