Outlook

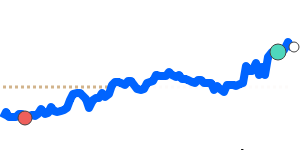

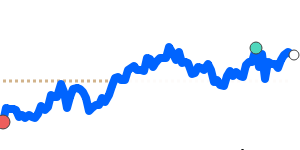

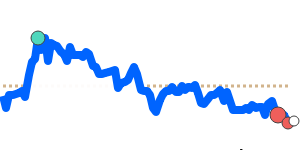

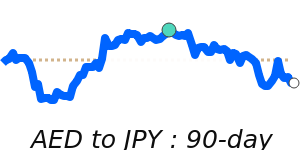

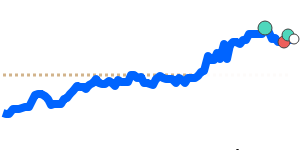

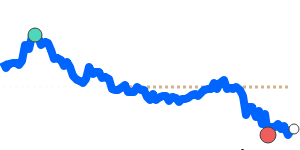

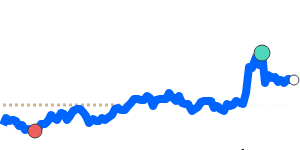

The yen stays in a narrow range as BOJ normalization and political risk keep traders cautious. JPY to USD around 0.006360, just under its 3-month average, with little drift across the major crosses. Markets expect possible further BOJ hikes if data improves, but election outcomes and trade tensions cap momentum.

Key drivers

- BOJ policy normalization: ending negative rates and hiking to 0.5%; markets see room for further hikes if data improves.

- Political risk: snap elections and expansionary fiscal policy add uncertainty for the yen.

- Trade data: a narrowed deficit exists, but U.S. tariffs and tensions cloud the outlook.

- Global risk appetite: volatility influences the yen’s safe-haven role and limits gains when risk levels rise.

Range

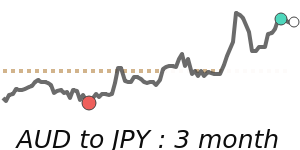

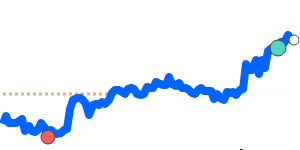

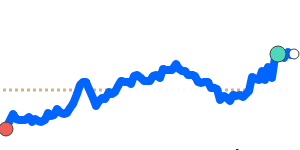

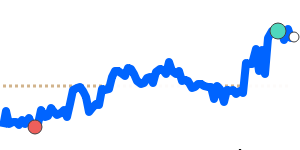

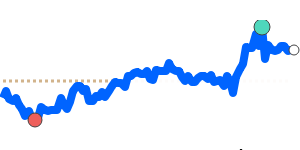

Current levels: JPY/USD around 0.006360 (0.8% below the 3-month average), in a 0.006284–0.006566 range; JPY/EUR about 0.005439, near the 3-month average, within 0.005370–0.005537; JPY/GBP about 0.004744, near the average, within 0.004666–0.004857.

What could change it

- A clearer BOJ path with stronger signals or larger rate hikes.

- Japan’s political developments or election results.

- A shift in global risk appetite or market volatility.

- New trade policy moves by major partners or tariff changes.