Outlook

The peso stays cautious in 2026. Growth is seen around 1.3% and Banxico holds at 7%; a U.S. tariff weighs on trade. Nearshoring inflows support the peso, but inflation above target keeps policy uncertain. Further data on inflation and growth will guide the policy bias in coming weeks.

Key drivers

- Nearshoring inflows support the peso.

- Banxico holds at 7% => limited tightening.

- U.S. tariffs weigh on the currency.

- Inflation above target shapes policy path.

Range

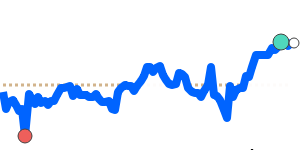

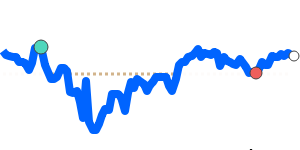

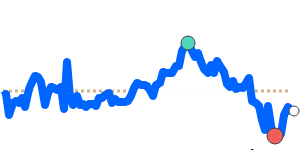

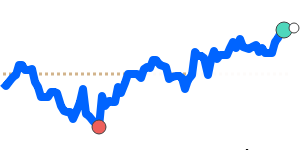

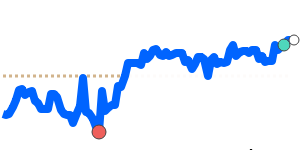

MXN/USD 0.056479, just below its 3-month average, in a 0.0548–0.0584 band. MXN/EUR 0.048658, about 0.8% above its average, in a 0.0471–0.0496 band. MXN/GBP 0.042286, ~0.6% above average, in a 0.0411–0.0433 band. MXN/JPY 8.8961, just above average, in a 8.5240–9.1351 band.

What could change it

- Risk appetite shifts could lift flows.

- Inflation trends guiding Banxico decisions.

- Trade developments with the U.S. could alter the bias.