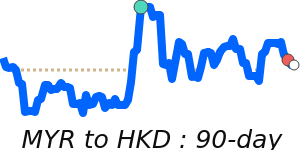

MYR Market Update

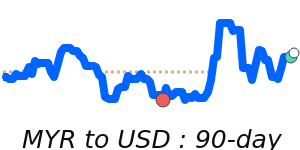

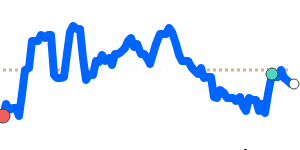

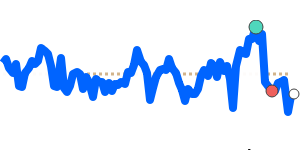

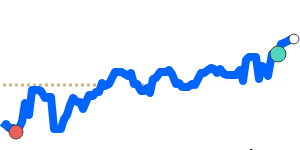

The Malaysian ringgit has recently traded near 30-day lows against the US dollar, around 0.2520, though it remains close to its three-month average of 0.2502. Despite the slight weakening, the currency has generally held within a stable range, supported by Malaysia's resilient economy, strong current account, and political stability.

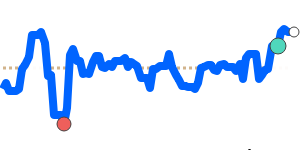

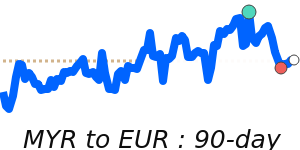

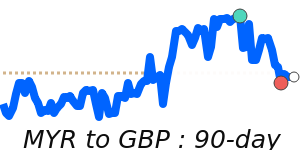

against the Euro and British pound, MYR has edged higher, now at about 0.2189 and 0.1896 respectively, both roughly 2-3% above their recent three-month averages. These moves reflect investor optimism driven by Malaysia's growing role in high-tech sectors and steady foreign investment flows.

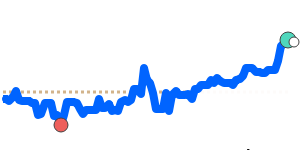

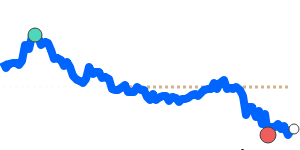

Meanwhile, MYR has strengthened slightly against the Japanese yen, trading near 40.00, about 2.4% above its 3-month average, indicating solid demand from Asian markets. Overall, the ringgit remains solid amid global uncertainties, with the outlook supported by Malaysia's steady growth prospects and stable monetary policy stance.