Outlook

Malaysia’s Ringgit remains supported by a solid domestic backdrop and a narrower policy-rate gap with the United States. A 5.2% third-quarter 2025 GDP print, strong domestic demand, firm exports, and gains from mining and construction underpin the outlook. Inflows from foreign direct investment—notably in data centers and semiconductor manufacturing—lend further support, while Bank Negara Malaysia’s policy rate at 2.75% helps narrow the rate differential with the Fed. Fiscal reforms, including subsidy rationalization, bolster fiscal credibility. If these themes persist and oil markets stay orderly, the MYR could hold near recent 90-day highs. Risks to this view include renewed oil-price volatility or a shift in global risk sentiment that strengthens the USD.

Key drivers

- Strong Economic Performance: Malaysia posted a 5.2% GDP growth in Q3 2025, driven by domestic consumption, exports, and key sectors like mining and construction.

- Increased Foreign Direct Investment (FDI): Investment in data centers and semiconductor manufacturing supports investor confidence and the MYR.

- Narrowing Interest Rate Differentials: Fed hikes have slowed while Bank Negara Malaysia kept the policy rate at 2.75%, narrowing the gap and supporting the currency.

- Fiscal Consolidation Efforts: Subsidy reforms and targeted subsidies improve fiscal discipline and underpin the MYR.

- Oil Price Movements: Oil price dynamics influence Malaysia’s export outlook and overall risk sentiment, adding a source of volatility.

Range

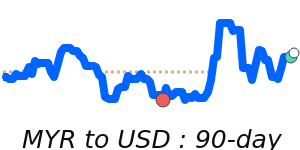

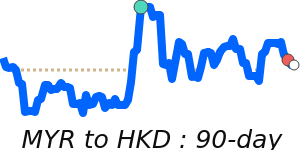

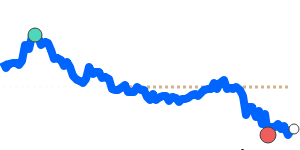

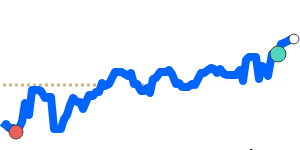

MYR/USD, around 0.2420–0.2574 (90-day high near 0.2574; 3-month average about 0.249; range roughly 6.4%).

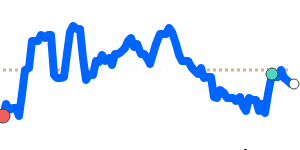

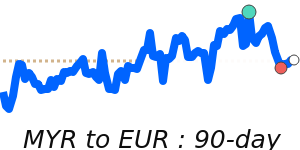

MYR/EUR, around 0.2072–0.2181 (90-day high near 0.2181; 3-month average about 0.2119; range roughly 5.3%).

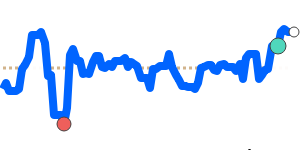

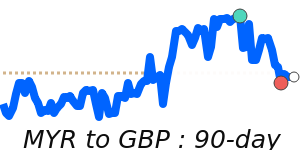

MYR/GBP, around 0.1813–0.1908 (3-month average about 0.1846; range roughly 5.2%).

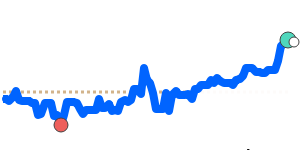

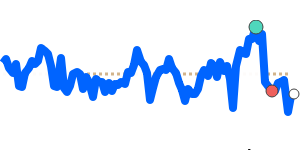

MYR/JPY, around 37.56–40.21 (3-month average about 38.84; range roughly 7.1%).

Brent Crude OIL/USD, around 59.04–71.76 (7-day low near 70.86; range about 21.5%).

What could change it

- US rate path: A new round of Fed tightening or a quicker-than-expected pivot could widen or shrink the rate differential and move the MYR.

- Oil price moves: A sustained rally or retreat in crude could add upside or downside pressure on the MYR via export earnings and risk sentiment.

- FDI and domestic policy developments: Further large-scale investment or additional subsidy reforms could reinforce the positive drift; reversals could weigh on the MYR.

- Malaysia growth data: Surprises in GDP, trade, or inflation data could shift near-term expectations for the currency.

- Global risk sentiment: A shift toward risk-off or risk-on conditions can influence cross-asset flows and currency performance.

- Geopolitical events: Significant geopolitical developments could alter funding flows and risk appetite affecting the MYR.