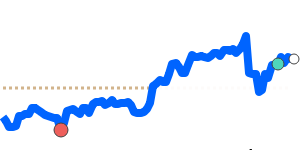

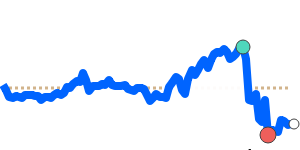

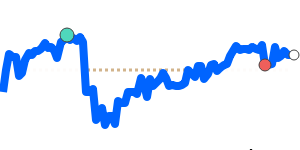

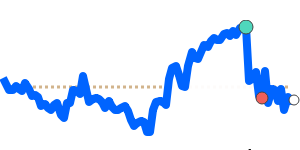

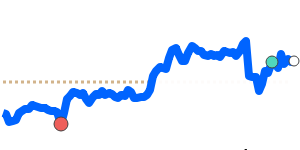

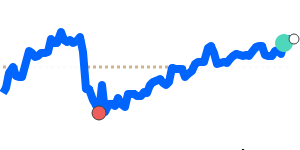

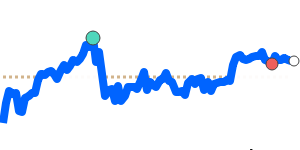

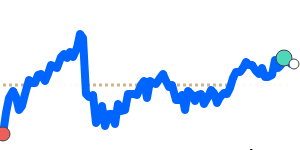

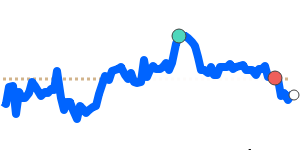

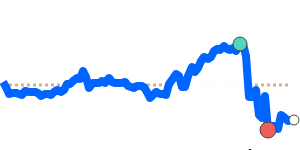

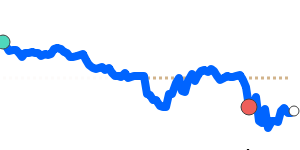

USD/NOK Outlook:

The USD/NOK is currently bearish, trading significantly below its recent average and near its recent lows. This trend is mainly influenced by the strong performance of the NOK against the USD and pressure from external market factors.

Key drivers:

• Rate gap: The Federal Reserve's approach to interest rates remains cautious, while Norges Bank is expected to maintain its current monetary policy, supporting the NOK.

• Risk/commodities: As oil prices are currently at 90-day highs, this strengthens the NOK since Norway is a major oil exporter, creating upward pressure on the currency.

• Macro factor: Recent falls in US jobless claims indicate resilience in the US labor market, potentially affecting the overall strength of the USD.

Range:

Expect the USD/NOK to drift within its recent range, following the current downward trend.

What could change it:

• Upside risk: A significant shift in US economic data could boost the USD.

• Downside risk: Further appreciation of the NOK driven by rising oil prices or optimistic Norwegian economic forecasts could push the rate lower.