Outlook

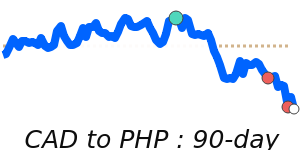

The PHP remains under near-term pressure as the BSP eases policy and external risks stay elevated. A steadier political climate and modest improvements in external demand could help limit losses, while global rate moves may add volatility.

Key drivers

- BSP easing continues, weighing on the peso.

- ORR-based peso IRS market growth improves policy transmission and liquidity in local markets, boosting hedging effectiveness.

- Political and fiscal risks raise stability concerns.

- FDI inflows fell, softening external support.

Range

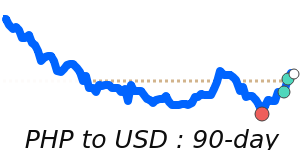

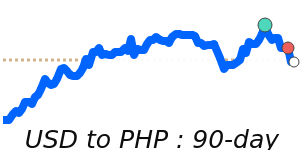

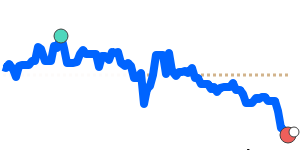

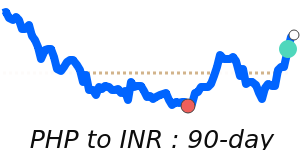

PHP/USD 0.017323 (+1.7% vs 3m avg 0.017034); range 0.016796–0.017389.

PHP/EUR 0.014734 (+1.7% vs 3m avg 0.01449); range 0.014088–0.014734.

PHP/GBP 0.012926 (+2.4% vs 3m avg 0.012628); range 0.012249–0.012943.

PHP/JPY 2.7135 (+2.1% vs 3m avg 2.6574); range 2.5814–2.7204.

What could change it

- BSP policy shifts or new inflation data.

- Political stability improvements or fiscal reforms boosting confidence.

- FDI rebound or external demand improving support.

- Global rate moves or EM flows shifting currency.