Outlook

The THB remains range-bound against USD, EUR, GBP and JPY as markets await fresh cues from U.S. data and Thai policy outlook. A mild pullback in dollar strength supports modest tolerance for Thai hedges, keeping cash flows predictable for importers and exporters.

Key drivers

- USD stability and global liquidity conditions support limited THB moves.

- Thai data and policy signals help set near-term rate expectations and flows.

- External demand and tourism trends influence THB demand from the region.

Range

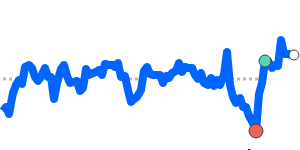

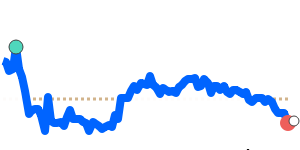

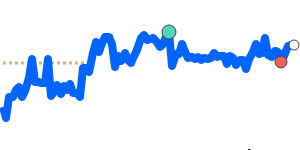

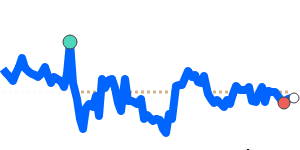

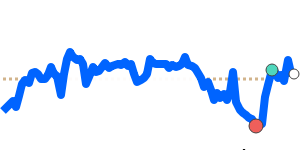

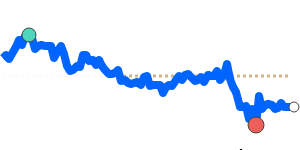

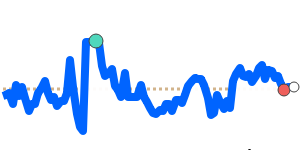

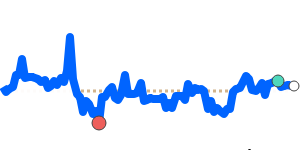

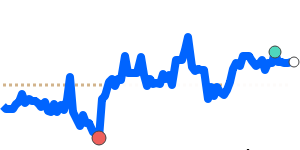

THB/USD near 0.031616 at 14-day lows, within a range of 0.031227–0.032456. THB/EUR near 0.027226 at 7-day lows, within 0.026701–0.027522. THB/GBP near 0.023689 at 7-day lows, within 0.023049–0.023989. THB/JPY near 4.9903 at 7-day lows, within 4.8434–5.1007. Overall, the range reflects a quiet market posture.

What could change it

- Surprise U.S. data or Fed messaging could broaden THB moves.

- Unexpected Thai policy changes or a shift in rate expectations can widen ranges.

- Shifts in regional risk appetite or capital flows could tilt THB in either direction.