You Can Save Money when you Compare Bank of Taiwan Exchange Rate Margins & Fees

The above comparison table makes it easy to calculate the Total Cost you are being charged on your currency transaction by ![]() Bank of Taiwan versus the below market mid-rate. It is easy to calculate any savings available from popular market-leading FX providers.

Bank of Taiwan versus the below market mid-rate. It is easy to calculate any savings available from popular market-leading FX providers.

Is Euro (EUR) expected to go up or down?

This is always a difficult question as exchange rates are influenced by many factors, so a good method to consider the Euro current value is to look the EUR performance against a range of other currencies over various time periods.

The following table looks at the performance of the EUR exchange rate against selections of other currencies over time periods from the previous 2 days back to the last 5 years.

Popular Rates (A - Z)

United Arab Emirates dirham to Indian rupee

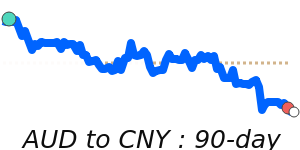

Australian dollar to Chinese yuan

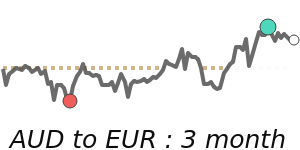

Australian dollar to Euro

Australian dollar to British pound

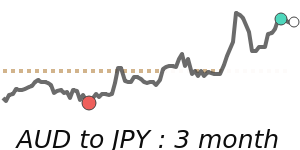

Australian dollar to Japanese yen

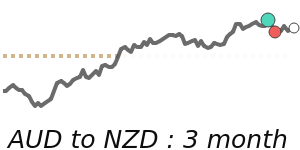

Australian dollar to New Zealand dollar

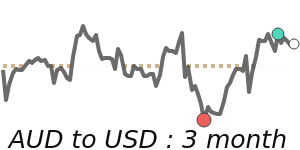

Australian dollar to US dollar

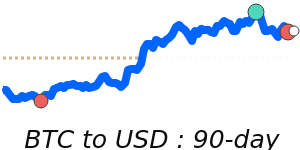

Bitcoin to US dollar

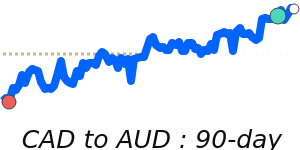

Canadian dollar to Australian dollar

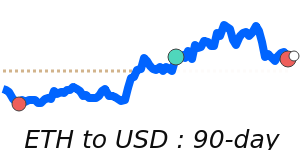

Etherium to US dollar

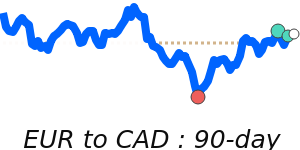

Euro to Canadian dollar

Euro to British pound

Euro to Japanese yen

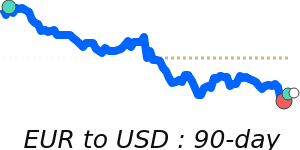

Euro to US dollar

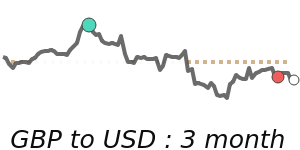

British pound to US dollar

British pound to US dollar

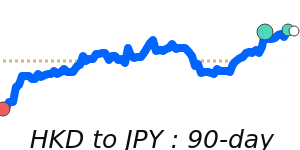

Hong Kong dollar to Japanese yen

New Zealand dollar to British pound

New Zealand dollar to US dollar

Brent Crude Oil to US dollar

US dollar to Canadian dollar

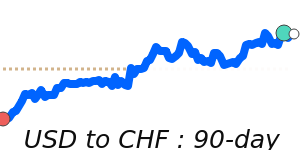

US dollar to Swiss franc

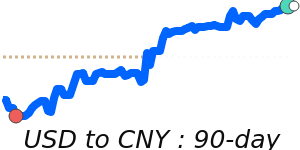

US dollar to Chinese yuan

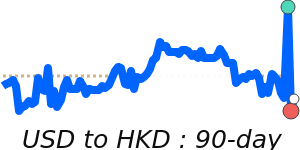

US dollar to Hong Kong dollar

US dollar to Japanese yen

US dollar to Mexican peso

US dollar to Philippine peso

US dollar to Singapore dollar

View a full list of exchange rates by selecting your Base (from) currency: