How much does it really cost to live, work, or travel in ? Here's what to expect for daily expenses and expat living.

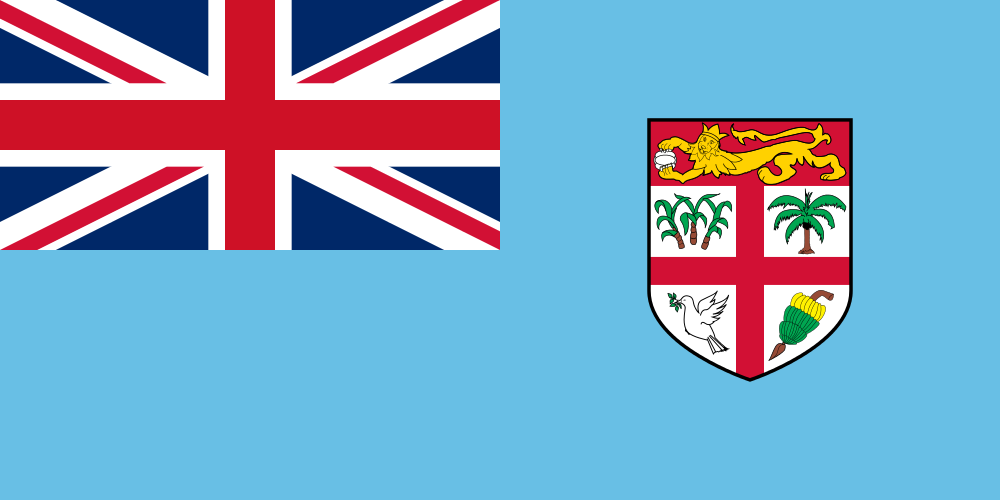

Currency Guide to Fiji (ISO Code: FJ)

When planning a one-week mid-range stay in Fiji, travelers should budget approximately FJD 2,500 to FJD 3,500 (around USD 1,100 to USD 1,550) to cover accommodation, meals, activities, and transportation. Here’s a quick overview of typical daily expenses in Fijian dollars (FJD) to give you a sense of what to expect:

- 🍽️ Meal at a local restaurant: FJD 20-40

- 🚌 Public transport fare: FJD 1.50-5

- 📱 Prepaid SIM card: FJD 25-40

- 🏨 Budget hotel or Airbnb: FJD 100-200 per night

In terms of overall affordability, Fiji can be considered relatively expensive compared to the United States and average when compared to Australia. In the U.S., travelers often find meals and accommodations to be slightly less expensive, while in Australia, prices for daily essentials in Fiji are typically on par.

Expats in Fiji: Living Costs and Tips

For expats settling in Fiji, the typical monthly living costs can range from FJD 2,500 to FJD 4,500 (USD 1,100 to USD 2,000), depending on lifestyle choices. This generally includes rent for a decent apartment, utilities, groceries, and leisure activities. When managing finances, it’s crucial to stay informed about banking options. Local banks offer basic services, but using international credit cards is also commonplace, particularly in tourist areas.

For sending or receiving money, online transfer services like Wise or OFX often provide better exchange rates and lower fees than traditional banks. It's usually advisable to exchange a small amount of cash locally for immediate expenses while relying on these transfer services for larger transactions, as they can minimize the overall cost of managing your finances abroad. In summary, expatriates in Fiji will find it advantageous to balance local currency use with online financial solutions for the best experience.