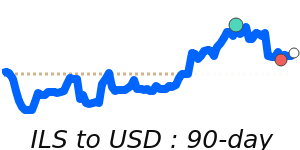

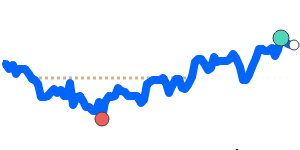

USD to ILS Forecast & Outlook

In the near term, USD/ILS is trading close to its 90-day average and near the recent lows, with the dominant driver being risk sentiment. Current conditions suggest that safe-haven flows due to geopolitical tensions are supporting the US Dollar. The pair’s recent confinement within a narrow range indicates cautious sentiment. Near-term, the pair may remain supported by risk-off conditions, but could face downward pressure if risk appetite improves.

Transfer implications

- Expats: sending money to Israel may face slightly less favourable conditions if the pair continues to weaken.

- Travellers: buying ILS with USD might become marginally more expensive if the pair declines further.

- Businesses: paying overseas ILS invoices with USD may see a slight decline in value, making payments less advantageous.

Key drivers

- Rate gap: No policy bias; both currencies are free-floating with no explicit policy hint.

- Risk/commodities: Risk-off environment supported by geopolitical tensions and regional uncertainties.

- Global factors: Elevated regional tensions and geopolitical developments influence risk sentiment.

What could change it

- Upside risk: Risk sentiment improves, reducing safe-haven demand for USD and supporting the ILS.

- Downside risk: Further escalation of geopolitical tensions may sustain the US Dollar’s safe-haven support.

Shopping around for the lowest margin provider may help reduce overall transfer costs.